Basic Approach to Climate Change

The effects of climate change are having a serious impact on the environment, society, people's lives, and corporate activities.

With the conclusion of the Paris Agreement in 2015 to promote the reduction of greenhouse gas emissions worldwide, expectations for the role to be played by the private sector are increasing.

The NAGASE Group analyze the medium- and long-term opportunities and threats posed by climate change, as well as its financial impact, and develop business strategies required for a low-carbon and recycling-oriented society. In addition, we identify the GHGs emitted by the business activities of our Company and the entire value chain, and set medium- to long-term goals and action plans for the reduction process.

The NAGASE Group endorsed the suggestions of the Task Force on Climate-related Financial Disclosures (TCFD) established by the Financial Stability Board (FSB) on January 25, 2022.

In addition, in line with the TCFD, information related to climate change is actively disclosed under the themes of Governance, Strategy, Risk Management, and Metrics and Targets.

Membership in organizations working on climate change issues

Japan Climate Initiative

The NAGASE Group is a member of the Japan Climate Initiative (JCI), which calls for "Joining the front line of the global push for decarbonization from Japan."

Japan Foreign Trade Council / Global Environment Committee

Our Company's Representative Director, President and CEO serves as Executive Director of the Japan Foreign Trade Council. As a member of the Global Environment Committee, our Company participates in committee activities and promotes activities related to climate change and other issues.

Zero Emission Challenge

NAGASE & CO., LTD. is participating in the Ministry of Economy, Trade and Industry’s Zero Emission Challenge for the realization of 2050 carbon neutrality with the project Development of Production Technology for Bio-based Products to Accelerate Carbon Recycling.s

Governance

Monitoring system of climate-related risks and opportunities by the Board of Directors

The NAGASE Group recognizes climate change as one of its important management issues and has established the Sustainability Committee and the Risk Management and Compliance Committee under the supervision of the Board of Directors to study and discuss policies and issues. In FY2021, the Board of Directors approved the NAGASE Carbon Neutral Declaration and Supporting Statement of TCFD, and the action policy based on this declaration was set as a non-financial target of ACE 2.0, the mid-term management plan, leading to the disclosure of single-year results. In this way, climate change is regularly and directly supervised by the Board of Directors.

Risk Management & Compliance Committee, Sustainability Committee

Risks and business opportunities related to the environment, including climate change, as well as policies for addressing them, are discussed at the Risk Management and Compliance Committee and the Sustainability Committee. The content of the deliberations, including disasters that are physical risks associated with climate change, changes in regulations that are climate risks, the issuance of new regulations, and responses to market changes and risks related to reputation, is reflected in our business activities through the Sustainability Office, which is the executive organization for the business.

It was also decided that in FY2020 climate change related KPIs will be set in the mid-term management plan (2021-25) within the KPI setting for climate change related and non-financial information.

| Meeting committee structure | Content of deliberation |

|---|---|

| Risk Management & Compliance Committee (Chairperson: Director in Charge and Executive Officer) | Risks related to damage caused by natural disasters such as floods and large typhoons that may occur owing to climate change |

| Sustainability Committee (Chairperson: Representative Director and President) | Incorporating risks and opportunities for sustainability issues that include climate change into business strategies (consideration of setting climate change related KPIs) |

Engagement with policymakers

The NAGASE Group is engaging with policymakers as shown below.

| Focus of the law | Corporate position | Specific details of the collaboration | Proposed legislative solutions | Mandatory carbon reporting | Support | More than 99% of the Scope 1 and Scope 2 emissions from the NAGASE Group come from within Japan. For this reason, the NAGASE Group is working with Japanese regulations. In accordance with the Act on Promotion of Global Warming Countermeasures ("Global Warming Countermeasures Act") and the Act on the Rationalization etc. of Energy Use ("Energy Saving Act"), both of which cover businesses in Japan, the NAGASE Group has been reducing greenhouse gas emissions and energy consumption, and reporting the amount of emissions and consumption. We support these laws and policymakers in implementing reduction activities and reporting appropriately. | Support without exception (laws and regulations concerning reduction of greenhouse gas emissions and energy consumption) |

|---|

In addition, we support the Japanese government's statement to reduce greenhouse gas emissions by 46% from the FY2013 level by 2030 and have established our Company target to manage greenhouse gas emissions from a long-term perspective.

Strategy

Risks and opportunities

In FY2021, we conducted a risk and opportunity materiality assessment within the NAGASE Group's climate change strategy. Amid various risks and opportunities related to climate change, we have identified the following important risks and opportunities for the NAGASE Group.

Specific processes for climate-related risks and opportunities

The Carbon Neutral Project was established in July 2021 as a project within the Sustainability Committee. In the project, we started discussions on supporting TCFD and setting and disclosing long-term goals on climate change within FY2021. Analysis of the risks and opportunities that arose from the discussions was reported to employees at a climate change briefing in November 2021, and a climate-change workshop was held by representatives of business units in December. In the workshop, we shared and discussed issues that should be addressed across the Group, focusing on opportunities related to climate change.

Climate Change Workshop

Risk

Transition risks

| Classification | Main content | Degree of influence |

|---|---|---|

| Policies and laws and regulations |

・Regulations such as carbon pricing and emissions trading (in particular, considering the impact of price shifting by material manufacturers with high GHG emissions) ・Cost of measures to comply with relevant laws and regulations (Act on Promotion of Global Warming Countermeasures, Act Concerning the Promotion of Resource Recycling for Plastics, Reinforcement of Regulations on Petrochemical Products, etc.) |

Large |

| Market and technology |

・Decreased customer preference for petrochemical products, reduced market demand, and reduced sales ・The era of mass production, mass consumption, and mass disposal comes to an end, and there is a delay in the transition to environmentally friendly products. |

Large |

| Reputation | ・Decline in stakeholder trust and external evaluation due to lack of initiatives and information disclosure | Small |

Physical risk

| Classification | Main content | Degree of influence |

|---|---|---|

| Acute |

・Supply chain disruption due to large-scale natural disasters and sluggish sales and production activities ・Interruption of water supply due to flood or drought ・Increase of temperature control energy due to higher temperatures or colder temperatures |

Large |

| Chronic |

・Serious impact on areas around coastal activity sites due to sea level rise (submergence and tsunami response) ・Increase in market prices for procurement of primary commodities ・Additional measures to ensure the safety of employees' lives and reduced labor productivity |

Large |

Opportunity

| Classification | Main content | Degree of influence |

|---|---|---|

| Products and services |

・Providing alternative materials that contribute to improving energy efficiency (weight reduction, heat insulation, heat dissipation, etc.) ・Development of resource recycling-oriented materials (low carbon, biotechnology and biodegradability, recycling) ・LCA disclosure (visualization of emissions by product) and provision of high environmental value products ・Providing energy reduction solutions such as electricity and gas ・Visualization of emissions and provision of reduction solutions in the supply chain ・Provision of manufacturing technology and materials for new foods that contribute to the reduction of the global environmental impact, such as plant-based proteins and insect foods |

Large |

| Market |

・Materials market requiring reduction of raw material emissions (B to B in general) ・Product markets that require emission reductions in end products (mobility, OA, etc.) ・Consumer markets where demand is expected to increase owing to rising temperatures (skin care, daily necessities, home appliances, etc.) ・Emerging markets created by behavioral change of consumers with new values (alternative meat, circulars, emission disclosure products) |

Large |

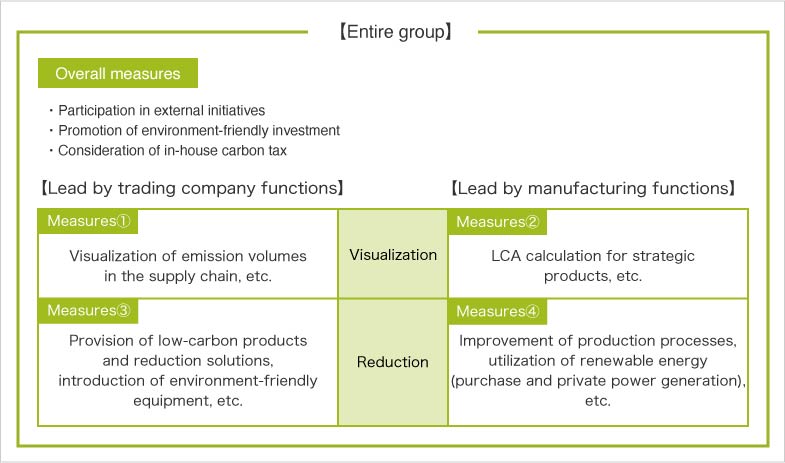

Strategy: Promote initiatives to achieve targets in two axes and four quadrants: Trading/Manufacturing and Visualization/Reduction

Since the NAGASE Group has manufacturing and processing functions in addition to its trading company functions, we have categorized our activities into two axes and four quadrants, Trading/Manufacturing and Visualization/Reduction, and will work to achieve our goals under The NAGASE Group Carbon Neutral Declaration(pdf:421 KB), which consists of overall measures and measures 1 through 4.

Risk management

Under the guidance of the Risk Management and Compliance Committee, the NAGASE Group have developed an environmental ISO management organization and are carrying out continuous activities for the ISO 14001 environmental management system.Specifically, the environmental impact assessment, survey on related laws and regulations, internal and external issues, needs and expectations of stakeholders, etc. are confirmed in the documents and forms of the environmental management system, risks and opportunities are recorded in the environmental aspect survey form, and internal and external audits are implemented. Meanwhile, the ISO 14001 environmental management system is determined in accordance with the environmental management manual and business procedures. For newly discovered risks, we conduct an environmental impact analysis in the documents and forms of environmental management system, and determine priorities based on the evaluation method.

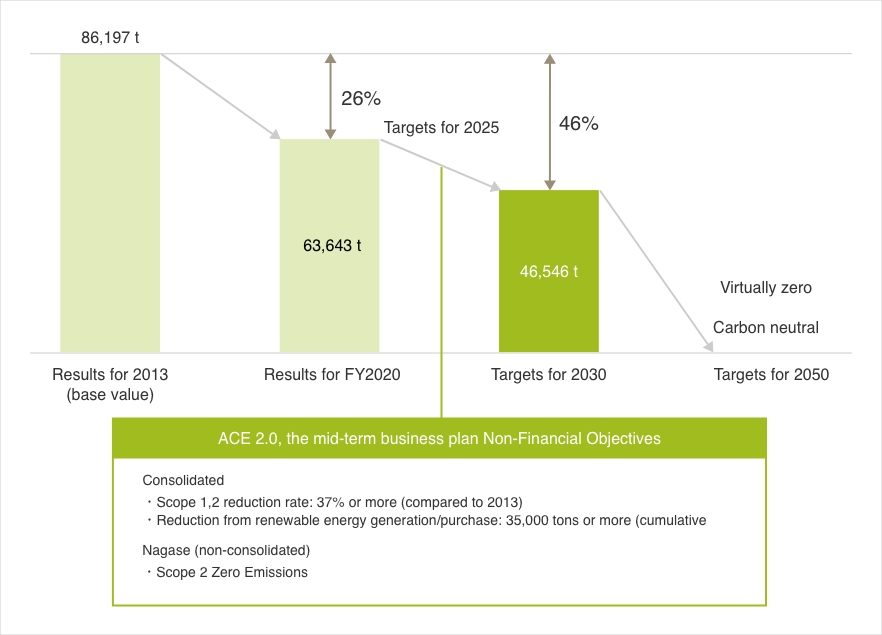

Metrics and targets

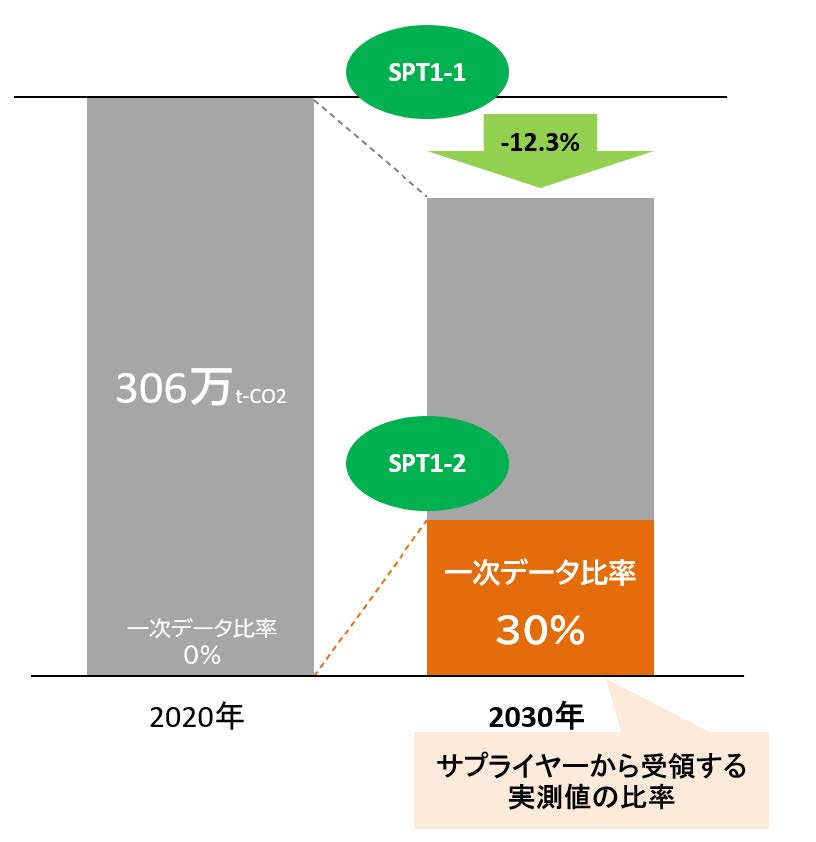

We are also committed to achieving carbon neutrality, which means virtually zero GHG emissions by 2050 (Scopes 1 and 2). We will also reduce Scopes 1 and 2 by 46% from 2013 level and Scope 3 by more than 12.3% from 2020 level by 2030.

We will consider updating the target value of Scope 3 through future dialogue with our supply chain.

Please refer to The NAGASE Group Carbon Neutral Declaration(pdf:421 KB) for details.

NAGASE Group greenhouse gas emissions (Scope 1 and Scope 2)

Actual results for FY2022

Carbon Neutral Project Major Initiatives for FY2022

Major Initiatives for FY2022

In FY2022, Nagase invested in Zeroboard Corporation, provided support for the visualization of GHG emissions in the printing industry supply chain, and conducted a forest credit generation demonstration. As a result, we have deepened our collaboration with Zeroboard, which provides GHG emissions visualization services, and are expanding our business not only in Japan but also in Southeast Asia.

In addition, we have been developing support for visualization of emissions in support of the "Supporting the Visualization of Emissions" project in the United States. In addition, we conducted a demonstration project for creating credits, which is expected to become increasingly important, and we believe we have made progress in accumulating knowledge and know-how toward becoming carbon neutral.

| KPI | FY2022 results Provisional values before guarantees by certifiers | |

|---|---|---|

| Carbon Neutral | 【Consolidated】 Scope1,2 reduction rate:37% or more (compared to 2013) Reduction from renewable energy generation and purchase:35,000 tons or more (cumulative total) |

【Consolidated】Scope1,2 reduction rate:34% |

| 【Non-consolidated】Scope 2 Zero emissions | 【Consolidated】Reduction from renewable energy generation and purchase:524 tons (cumulative total) 【Non-consolidated】Scope 2:1987t |

The NAGASE Group is a member of the Japan Foreign Trade Council. The NAGASE Group's approach to climate change is consistent with that of the Japan Foreign Trade Council, and the goals set by the Japan Foreign Trade Council are shared within the Environment ISO Secretariat.

Energy Consumption and Greenhouse Gas Emissions Initiatives

| Initiative | Details |

|---|---|

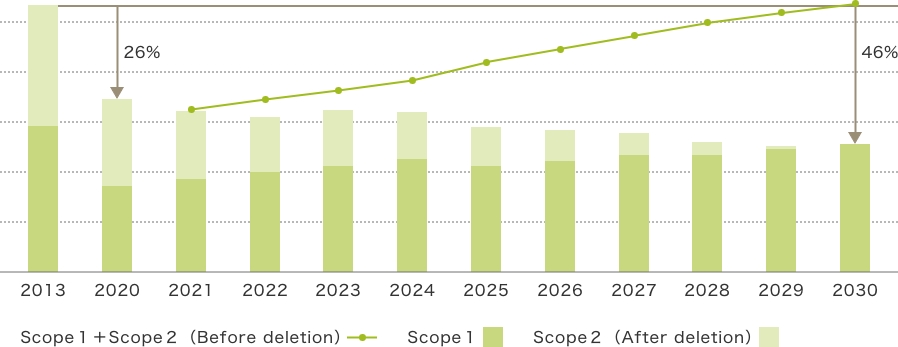

| Purchase and generation of renewable energy |

Renewable energy purchased generation and cost simulation to 2030In FY2022, the NAGASE Group reduced emissions by 404 t-Co2 through increased consumption of renewable energy (purchased and generated). In addition, a simulation of Scope 2 reduction by 2030 was conducted for companies participating in the Manufacturing Industry Collaboration Committee, which are large GHG emitters, and cost estimates of approximately 1 to 2 billion yen (cumulative total until 2030) were made.NAGASE Group Scope2 Deletion Image

Assumptions for estimationGraphs are for illustrative purposes only. Emissions up to FY2025 are based on the ACE2.0 plan, while sales and production growth rates for the ACE2.0 period are applied from FY2026 onward. In addition, the latest market standard values (FY2021) are applied for the CO2 emission coefficient for electricity. At our manufacturing sites, we are prioritizing reductions from Scope 2, and have set a target for Scope 1 that will allow for reductions even if production volume grows. |

| Purchase carbon credit |

Purchase carbon creditIn FY2022, the NAGASE Group purchased 485 tons of renewable energy. This credit is a verified credit. (Name of the corporation from which the transfer is being made: Yusuhara Corporation Name of the corporation to which the transfer is being made: Nagase & Co.) |

| Energy Efficiency Improvements |

Flow synthesis technology in chemical and pharmaceutical productionThe NAGASE Group proposes a method for manufacturing chemicals and pharmaceuticals of the future using the micro-flow synthesis method. Flow synthesis is a new chemical synthesis technology in which chemical reactions are carried out by pouring raw materials into microscopic flow channels without using the containers used in conventional chemical synthesis. Flow synthesis has been attracting attention in recent years because it has higher energy productivity and generates less waste than batch synthesis, which is a common method of producing chemical substances.Energy improvement measures at Nagase ChemteX Corp.Nagase ChemteX, a member of the NAGASE Group, is promoting a review of boiler number control operation methods, boiler upgrades, and the use of inverters for scrubbers. |

| Utilization of waste heat recovery and cogeneration systems |

Waste Heat Reuse and Other Initiatives by Nagase Viita Co.Nagase Viita Corporation, a member of the NAGASE Group, is promoting energy conservation (waste heat reuse, renewal management of defective steam traps, review of storage tank sterilization conditions, etc.) at each of its production plants. |

| Utilize carbon dioxide capture and storage (CSS) technology |

Capital and business alliance agreement signed to establish CCUS technologyNagase and Atomis have entered into a capital and business alliance agreement to establish a CCUS (Carbon Dioxide Capture, Utilization and Storage) technology that will not only separate and capture CO2, but also convert the captured CO2 into useful chemicals onsite for utilization. Capture, Utilization, and Storage (CCUS) technology, and offer it to customers as a solution for reducing CO2 emissions, thereby contributing to the realization of a decarbonized society. |

Issuance of Sustainability Linked Bonds

In June 2022, we issued our first Sustainability Linked Bond (*1) with the aim of contributing to solving social and environmental issues through our corporate activities.

Sustainability Linked Bonds Overview

| term of issue | 10 years |

|---|---|

| amount of issue | 10 billion yen |

| Publication Date | June 2022 |

| KPI |

KPI 1:Greenhouse gas emissions of the Group (Scope 1 and 2) KPI 2:Greenhouse gas emissions of the Group (Scope 3) |

| SPTs (*2) |

SPT 1:Reduce the Group's greenhouse gas emissions by 46% in FY2030 (compared to FY13) (Scope 1 and 2) SPT 2:Reduce the Group's greenhouse gas emissions by at least 12.3% in FY2030 (compared to FY2020) (Scope 3) |

| Bond Characteristics |

SPTs will be established as SPT1 and SPT2. If it is confirmed that any of the SPTs have not been achieved as of the judgment date, emission credits (credits/certificates of CO2 reduction value) will be purchased in an amount corresponding to the achievement status of the SPTs before the redemption of the Bonds in order to accelerate efforts to address climate change. When emission credits are purchased, the name of the credits, the date of transfer, and the amount purchased will be disclosed in the integrated report or on the website. If SPT1 is not achieved, an amount equivalent to 0.10% of the bond issue amount will be purchased; if SPT2 is not achieved, an amount equivalent to 0.05% of the bond issue amount will be purchased. (If both SPTs are not achieved, a total amount equivalent to 0.15% will be purchased.) However, in the event of force majeure matters, etc. under the emission rights purchase agreement (e.g., changes in trading system rules and regulations, system failures related to the transfer of emission rights, etc.), the Company will provide public interest incorporated associations, public interest foundations, international organizations, local government authorized NPOs, local governments and similar organizations that are engaged in environmental conservation activities with an amount equivalent to the amount of the Bonds (For the amount of donation based on the achievement of SPTs, please refer to the description in the Emission Credits section above.) The final recipient of the donation will be determined by the institution after a close examination of the factors that led to the non-achievement of the SPTs. |

| lead manager | Nomura Securities (administration), Daiwa Securities Co. , Mizuho Securities Co., Ltd. |

| Structuring Agent (*3) | Nomura Securities Co. |

- *1 A Sustainability Linked Bond is a bond whose terms vary depending on whether or not it meets predetermined sustainability/ESG objectives. The issuer of a Sustainability Linked Bond commits to improving future sustainability outcomes within an initially defined time horizon. Specifically, the instrument is based on the issuer's assessment of future performance using predetermined Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs), and the terms of the bond change depending on whether the SPTs set as target values to be achieved with respect to the KPIs are achieved. The terms of the bond will vary depending on whether or not the target figures set to be achieved with respect to the KPIs are achieved.

- *2 Sustainability Performance Targets (SPTs) are targets based on the issuer's management strategy that determine the terms of issuance of Sustainability Linked Bonds.

- *3 A structuring agent is a person who assists in the implementation of a Sustainability Linked Bond by providing advice on the development of the Sustainability Linked Bond framework and obtaining a second party opinion.

For more information on Sustainability Link Bonds, please see

Independent Assessment of Sustainability Linked Bond Eligibility

We have commissioned Rating and Investment Information, Inc. (R&I) to obtain a second party opinion on the credibility and environmental and social benefits of the Framework and its conformance with SLBP 2020.

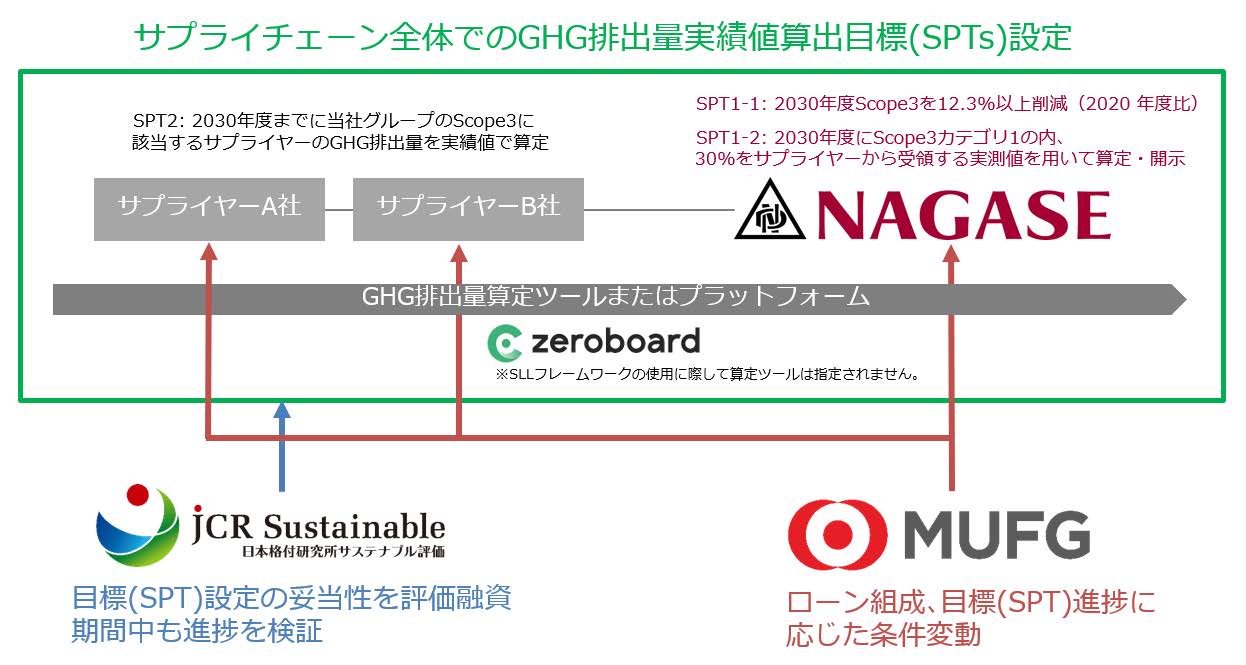

Sustainability Linked Loan Framework developed

The Sustainability Linked Loan (SLL) (*1) framework developed by NAGASE & CO., LTD. and Mitsubishi UFJ Bank Limited has been selected by the Ministry of the Environment as a model case study for the 2022 Green Finance Model Case Study Creation Project (*2).

Framework Scheme

- *1 Loans that encourage borrowers to meet ambitious, pre-determined Sustainability Performance Targets (SPTs).

- *2 For model cases and project summaries of the FY2022 Green Finance Model Case Study Creation Project, please refer to the following Selection of Model Case Study for FY2022 Green Finance Model Case Study Creation Project (NAGASE & CO., LTD.)

Features of the Framework

・Adoption of primary data (*1) ratios of GHG emissions as Sustainability Performance Targets (SPTs)

・The framework is designed to enable not only the company itself but also its suppliers to borrow using the framework, so that the entire supply chain can visualize and reduce GHG emissions.

NAGASE Group's Scope 3 reduction targets and SPTs

- *1 ① obtained from the company itself or its suppliers, ② company-specific activity data, emissions, or emissions intensity.

For details of the Sustainability Link Loan Framework, please refer to the following

Independent Assessment of Sustainability Linked Loan Eligibility

Our Sustainability Linked Loan Framework has been confirmed by the Ministry of the Environment and its contractor, Japan Credit Rating Agency, Inc. to be compatible with the Green Loan and Sustainability Linked Loan Guidelines 2022 and the Sustainability Linked Loan Principles 2022. Ltd.

Examples of initiatives

LCA Initiatives

Life Cycle Assessment (LCA) is a method to quantitatively evaluate the input resources, environmental impact, and potential environmental impact on the earth and the ecosystem of a product throughout its life cycle, from procurement of raw materials to production, distribution, use, and disposal. The NAGASE Group is promoting efforts to calculate environmental impact indicators such as CO2 emissions at the design stage through the calculation of LCA products.

Endorsement of the GX League Concept

NAGASE & CO., LTD. endorses the "GX League Basic Concept" announced by the Ministry of Economy, Trade and Industry (METI), which is a forum for companies actively engaged in Green Transformation (GX) to collaborate with government and academia to discuss reform of the entire economic and social system and to create new markets. GHX (Green Transformation) Minebea is committed to achieving carbon neutrality, which means virtually eliminating GHG emissions by 2050. The GX League will focus on the individual measures (1) "Visualization of emissions through the supply chain" and (3) "Provision of low-carbon products and reduction solutions, introduction of environmentally friendly equipment, etc." as its themes. The GX League will also use "zeroboard" as a tool for the promotion of the initiatives. In addition, the GX League will contribute to the achievement of the government's carbon neutrality target by providing support for CFP (Scope 3) calculations on an organizational basis using "zeroboard" and conducting CFP calculation trials on a product-by-product basis in collaboration with an IT company.

Demonstration project to optimize branch line logistics using small electric vehicles

Approximately 20% of Japan's GHG emissions come from the transportation sector. NAGASE Group believes that reducing emissions from mobility is an important issue in realizing a low-carbon society. In 2022, Nagase & Co., Ltd. conducted a demonstration experiment to operate a small electric vehicle (EV) in the delivery business field. The purpose of this project is to contribute to the shift to EVs in society as a whole by promoting the use of small EVs. In the logistics industry, not only is the labor shortage becoming serious, but also society's demand for decarbonization is increasing. Through the demonstration, we verified whether improvements can be seen in cost, operational efficiency, and CO2 emissions reduction. The demonstration test was carried out based on the Nagase & Co., Ltd.'s proposal of a demonstration project to optimize branch line logistics using small electric vehicles, which was selected for the FY2021 Subsidy for Advanced MaaS Implementation Acceleration Promotion Project, Including Unmanned Automated Driving solicited by the Ministry of Economy, Trade and Industry.

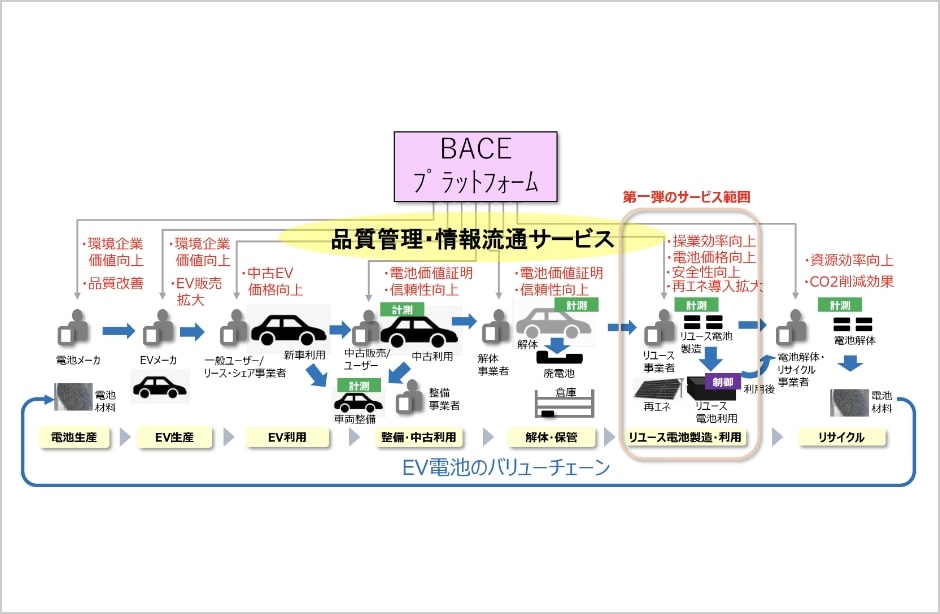

Toward commercialization of an EV battery residual value evaluation service

The NAGASE Group believes that the impact of disposable batteries on the environment will become an important social issue as EVs become increasingly popular. Nagase & Co., Ltd. is a member of the Battery Circular Ecosystem (BACE) Consortium, which aims to build a circular structure for EV-mounted automotive storage batteries. It has concluded agreements with The Japan Research Institute, Limited., Kaula, Inc., Hioki E. E. Corporation, Sumitomo Mitsui Finance and Leasing Company, Limited, and Yokogawa Solution Service Corporation, with the aim of commercializing a battery residual value evaluation service in China, and is verifying its commercialization. Nagase & Co., Ltd. aims to start providing the service, taking advantage of its various networks in China, in cooperation with other participating companies, mainly through its group company, Guangzhou Nagase Trading Ltd.

DNP and Nagase launch joint CFP quantification consulting service.

The carbon footprint of cosmetics and pharmaceuticals is visualized in the entire lifecycle of the product, including raw materials and packaging. (hereinafter referred to as “CFP”) calculation consulting service from July, 2023.

DNP has long been engaged in GHG accounting for the entire lifecycle of packaging products, from raw material procurement and manufacturing to disposal and recycling, while Nagase Sangyo has been promoting visualization and reduction of GHG emissions throughout the entire supply chain, including suppliers and customers, based on its network and know-how accumulated through its experience as a specialized chemical trading company. By combining the strengths of Nagase Sangyo, which has been promoting the visualization and reduction of GHG emissions throughout the entire supply chain, including suppliers and customers, based on its network and know-how cultivated as a specialized chemical trading company, we will provide comprehensive consulting support for CFP calculations and aim to achieve carbon neutrality.