Basic Approach

The effects of climate change are having a serious impact on the environment, society, people's lives, and corporate activities.

With the conclusion of the Paris Agreement in 2015 to promote the reduction of greenhouse gas (GHG) emissions worldwide, expectations for the role to be played by the private sector are increasing.

The NAGASE Group believes that it is important to respond to changes and expectations in the world and has set “Realize a Decarbonization” as one of our materiality. We also analyze the medium- to long-term risks and opportunities posed by climate change and their financial impact and develop business strategies required for a low-carbon society and a circular economy. In addition, we also identify the GHG emissions from our own business activities and the entire value chain and set medium- to long-term targets and activity plans for the reduction process.

The NAGASE Group endorsed the suggestions of the Task Force on Climate-related Financial Disclosures (TCFD) established by the Financial Stability Board (FSB) on January 25, 2022. And in line with the TCFD, information related to climate change is actively disclosed under the themes of Governance, Strategy, Risk Management, and Metrics and Targets.

For details, please refer to “Information Disclosure Based on the TCFD Recommendations.”

Governance

Board Oversight of Climate Risks and Opportunities

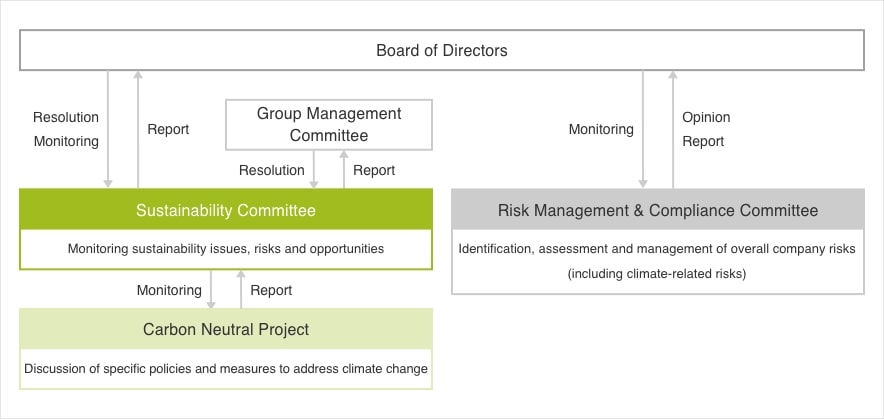

The NAGASE Group recognizes climate change as one of its important management issues and has established the Sustainability Committee and the Risk Management and Compliance Committee under the supervision of the Board of Directors to study and discuss policies and issues. Each committee reports regularly to the Board of Directors, so our actions on climate change are regularly and directly monitored by the Board of Directors.

Sustainability Committee, Risk Management & Compliance Committee

Risks and business opportunities related to the environment, including climate change, and our policies on these issues are deliberated by the Sustainability Committee, and in particular, risks are also reported to the Risk Management & Compliance Committee as part of our overall company-wide risk management. The content of the deliberations, such as dealing with disasters that pose physical risks due to climate change, changes in regulations that pose climate risks, issuing new regulations, and risks related to market changes and reputation, are reflected in business activities through the Corporate Sustainability Office, which is the organization responsible for business execution.

In addition, the NAGASE Group has set up the Carbon Neutral Project as a subordinate organization of the Sustainability Committee. This project is an advisory body at the executive level, and specific policies and initiatives related to climate change are realized through discussions within the project.

| Meeting committee structure | Frequency (FY2024) | Content of deliberation | Main topics for this year | |

|---|---|---|---|---|

| Sustainability Committee (Chairperson: Director in Charge and Executive Officer) | 9 times / year | Policy formulation for promoting group-wide sustainability, establishment and enhancement of promotion systems, monitoring of initiatives, and educational activities within the group. | ・Incorporating risk and opportunity into business strategy ・Formation and monitoring of Carbon Neutral Project ・Revision of materiality, including climate change-related issues ・Setting and monitoring of KPIs for the Mid-term Management Plan ACE2.0, targets for carbon neutrality, etc. | |

| Carbon Neutral Project | 9 times / year | Executive-level advisory body on initiatives to achieve the “NAGASE Group Carbon Neutral Declaration” | ・Discussion of measures to achieve the carbon neutral target in the Mid-term Management Plan ACE2.0. ・Considering obtaining SBT certification ・Discussion on the implementation of internal carbon pricing | |

| Risk Management & Compliance Committee (Chairperson: Director in Charge and Executive Officer) | 3 times / year | Establishment and enhancement of risk management and compliance systems for overall company risks (including risks related to environmental issues such as climate change) | ・Update of company-wide risk management (including climate change-related risks) | |

- ※ Only the content related to sustainability and climate change is excerpted for the Risk and Compliance Committee.

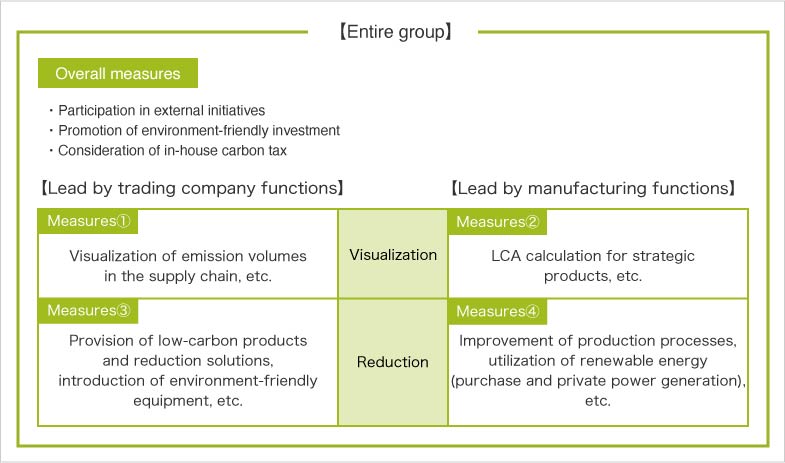

Strategy

Since the NAGASE Group has manufacturing and processing functions in addition to its trading company functions, we have categorized our activities into two axes and four quadrants, Trading / Manufacturing and Visualization/Reduction, and will work to achieve our goals under The NAGASE Group Carbon Neutral Declaration(pdf:298 KB), which consists of overall measures and measures 1 through 4.

In addition, based on our Basic Approach to Climate Change, we analyze and identify the medium- to long-term risks and opportunities posed by climate change and their financial impact, in order to develop business strategies that will help create a low-carbon and/or circular economy.

2×2 Matrix Strategy :

Trading vs. Manufacturing / Visualization vs. Reduction

NAGASE Group's Risks and Opportunities

NAGASE Group identifies and analyzes the medium- to long-term risks and opportunities posed by climate change and its financial impact in order to develop business strategies that contribute to a low-carbon and circular economy.

We have trading, manufacturing and R&D functions, and we are developing our business globally and in a variety of ways. Our group's business is currently divided into five segments: Functional Materials, Advanced Materials & Processing, Electronics & Energy, Mobility, and Life & Healthcare, and we provide a wide range of products, such as resins, plastics, electronic and semiconductor materials, and pharmaceuticals and cosmetics.

In addition, we have more than 110 bases around the world and have a very extensive value chain with about 18,000 global business partners.

In identifying climate change risks and opportunities, we assessed their significance as “Large,” “Medium,” or ”Small” from the perspectives of “impact on business (qualitative and quantitative)” and “likelihood of occurrence,” taking into account these characteristics of our company.These evaluations take into account the impact on business and finance under the 1.5℃ scenario and the 3-4℃ scenario for FY2030 and FY2050, respectively.(Please refer to “Risk Management” for details on the specific method.)

As a result, for our company, a failure to meet the stricter regulations and social demands related to climate change, and changes in customer demand, was assessed as having a high level of importance as a transition risk due to climate change. On the other hand, we believe that if we can grasp these social, customer and market changes and provide appropriate materials, products and solutions to the society, it will lead to a great business opportunity.

As for physical risks, the impact of natural disasters and other incidents is a significant risk that needs to be considered not only for the company's own sites but also for sites in the supply chains. With our foundation in the trading business, we have set “Achieve a Sustainable Supply Chain” as a materiality, and we are committed to maintaining and ensuring a stable supply of our products through our network of approximately 18,000 global business partners.

Risks

| Classification | Main items | Influenced functions | Influenced value chain | Evaluation Methodology | Level of Importance | ||

|---|---|---|---|---|---|---|---|

| 1.5℃ | 3~4℃ | ||||||

| Transition risk | Policies and Regulations | Stricter regulations on carbon taxes and emissions trading | Whole company | Upstream / Our Group | Qualitative / Quantitative | Large | Medium |

| Stricter regulations on products that we handle | Whole company | Whole value chains | Qualitative | Medium | - | ||

| Markets and Technology | Meeting the changing needs of clients | Whole company | Whole value chains | Qualitative | Large | - | |

| Calculation of LCA/CFP and meeting requests for environmental certification | Trading / Manufacturing | Upstream / Our Group | Qualitative / Quantitative | Medium | Medium | ||

| Structural Transformation of the Chemical Industry and supply chains | Trading / Manufacturing | Whole value chains | Qualitative | Large | - | ||

| Increase costs related to energy and logistics | Manufacturing | Upstream / Our Group | Qualitative / Quantitative | Medium | Medium | ||

| Replacement with low-carbon technology, Impairment of current assets | Manufacturing | Our Group | Qualitative / Quantitative | Medium | - | ||

| Reputation | Damage to our brand and reputation due to delays in decarbonization efforts | Whole company | Our Group | Qualitative / Quantitative | Medium | - | |

| Burden of complying with disclosure and reporting obligations related to climate change | Whole company | Our Group | Qualitative / Quantitative | Small | - | ||

| Physical risks | Acute | Impact on our company and supply chains due to natural disasters, etc. | Whole company | Whole value chains | Qualitative / Quantitative | - | Medium |

| Increase costs and difficulty in joining insurances | Whole company | Our Group | Qualitative / Quantitative | - | Small | ||

| Chronic | Impact on our sites due to rising sea levels, etc. | Manufacturing | Our Group | Qualitative / Quantitative | - | Medium | |

| Increase in market prices of natural materials | Manufacturing | Upstream / Our Group | Qualitative | - | Medium | ||

| Impact on employee health and productivity due to climate change | Manufacturing | Our Group | Qualitative / Quantitative | - | Medium | ||

Opportunities

| Classification | Main items | Influenced functions | Influenced value chain | Evaluation Methodology | Level of Importance | |

|---|---|---|---|---|---|---|

| 1.5℃ | 3~4℃ | |||||

| Products and services | Increase the demand for materials, products and services that contribute to a circular economy | Trading / Manufacturing | Whole value chains | Qualitative / Quantitative | Large | - |

| Increase the demand for materials, products and services that contribute to reducing GHG emissions | Trading / Manufacturing | Whole value chains | Qualitative / Quantitative | Large | - | |

| Increased the demand for products that meet changes in lifestyle | Trading / Manufacturing | Whole value chains | Qualitative / Quantitative | - | Medium | |

| Increased the demand for LCA/CFP calculations and environmental certification. | Trading / Manufacturing | Whole value chains | Qualitative | Medium | - | |

| Increase the demand for products and services that contribute to infrastructure resilience | Manufacturing | Whole value chains | Qualitative / Quantitative | - | Medium | |

| Market | Entering new markets and expanding markets due to changing needs | Whole company | Whole value chains | Qualitative | Medium | - |

| Expansion of the renewable energies market (Increase the demand for power generation, storage batteries, etc.) | Manufacturing | Whole value chains | Qualitative / Quantitative | Medium | - | |

| Structural Transformation of the Chemical Industry and supply chains | Whole company | Whole value chains | Qualitative | Large | - | |

| Recruitment of talented people/Improving Employee Engagement | Whole company | Our Group | Qualitative | Medium | - | |

| Cost reduction through energy-saving and high-efficiency manufacturing processes | Manufacturing | Our Group | Qualitative | Small | Small | |

- ○ Influenced functions

・Especially affected functions among trading, manufacturing and R&D functions.

・The term “whole company” refers to the company-wide impact of all trading, manufacturing and R&D functions. - ○ Influenced value chain

・The stage of the value chain that is particularly affected, among “Upstream” “Downstream” and “Our Group”.

・“Upstream” mainly refers to the influence of procurement and logistics (transportation), and, ‘Downstream’ mainly refers to the influence of sales and logistics (transportation).

・“Whole value chains” refers to the impact on the entire value chain, including “Upstream“, “Downstream” and “Our Group”. - ○ Level of Importance

The quantitative assessment is based on the impact on the operating income.

Large : Approx. more than 10% in terms of operating income (more than 3.5 billion yen)

Medium : Approx. 2.5-10% in terms of operating income (0.9-3.5 billion yen)

Small : Approx. less than 2.5% in terms of operating income (less than 0.9 billion yen)

Reference scenario

【1.5℃ scenario】

・IEA:Net Zero Emissions by 2050 Scenario(World Energy Outlook2024)

・IPCC:SSP1-1.9(AR6)

【3-4℃ scenario】

・IEA:Stated Policies Scenario (STEPS)(World Energy Outlook2024)

・IPCC:SSP5-8.5(AR6)

Response to Risks and Opportunities

The NAGASE Group is taking the following initiatives to minimize risks and maximize opportunities.

As a result of scenario analysis, we have determined that achieving our GHG emission reduction targets will have a lower financial impact than not achieving them. Therefore, we plan to steadily implement decarbonization measures such as utilizing renewable energy and improving energy efficiency.

Additionally, our company has assessed the inability to respond to strengthened climate-related regulations, societal demands, and changes in customer needs as a significant risk. We believe addressing these societal, customer, and market changes by providing the world with appropriate materials, products, and solutions could present a significant opportunity.

Risk management

The NAGASE Group has identified the risks and opportunities that are important for our group, while there are various risks and opportunities related to climate change. The identified risks and opportunities are reported to the Group Management Committee, Board of Directors and other bodies by the Sustainability Committee and Risk Management & Compliance Committee.Then, we reflect them in our business activities while receiving necessary instructions and advice, and we are regularly and directly monitored by the Board of Directors through this process.

In addition, responses to identified risks and opportunities are reflected in business activities through the Corporate Sustainability Office, which is the organization responsible for business execution.

Monitoring by the Board of Directors

Responses and initiatives related to climate change are reported by the Sustainability Committee to the Group Management Committee, Board of Directors, and other bodies, and are discussed, decided, and implemented. In particular, the Risk Management & Compliance Committee reports on risks, including those related to climate change, to the Board of Directors and other bodies as part of the company's overall risk management.

When making decisions and taking action on climate change, we report progress to the Board of Directors and each committee, and receive necessary instructions and advice, etc., and are subject to monitoring.

Sustainability Committee

This committee continuously monitors “risks” and “opportunities” that are specific to sustainability issues. In addition, the Carbon Neutral Project has been established as a subordinate organization of the Sustainability Committee. This project is an advisory body at the executive level. Specific policies and measures related to climate change are discussed by this project and reported to the Sustainability Committee and other bodies for implementation.

Risk Management & Compliance Committee

This committee identifies, evaluates and manages overall company-wide risks. As part of this risk assessment, the risks that environmental issues such as climate change pose to our group's business are also considered and reflected in management. This risk assessment is evaluated and reviewed at least once a year.

In addition, we used “impact” and “likelihood of occurrence” as indicators in line with the company-wide risk assessment to evaluate the risks and opportunities associated with climate change on a 4-level scale. The results were then classified into “High”, “Medium” and “Small” categories according to their importance to our business.

Risk Management System

Environmental Management System (ISO14001)

The NAGASE Group's main manufacturing sites have acquired ISO 14001 certification. Under this ongoing initiative, we are also evaluating risks and opportunities through environmental impact assessments and surveys of related regulations, and we have a system of internal and external audits.

Process for identifying risks and opportunities

FY2021

When the NAGASE Group endorsed the TCFD in FY2021, we identified and assessed the significance of risks and opportunities related to climate change. We finally identified them through discussions at the Carbon Neutral Project and at the “Climate Change Workshop” involving the business division and group companies.

FY2024

We revised our risks and opportunities in light of changes in the external environment and social demands.The revision was carried out using the following process, and we ultimately identified our risks and opportunities.

① We analyzed the external environment and organized the value chain, and then comprehensively reassessed all the risks and opportunities related to our business.

② Through workshops and interviews, we discussed with the business division and group companies.

③ Assess the qualitative importance of the issue using the “impact on business” and “likelihood of occurrence” indicators.

④Conducted financial impact assessments on items deemed important

⑤Determine importance based on the results of these scenario analyses.

⑥Consider response measures and conduct resilience assessments

⑦Conduct interviews with business divisions and group companies, report to the Carbon Neutral Project, and complete the identification process.

Workshop in 2024

Metrics and targets

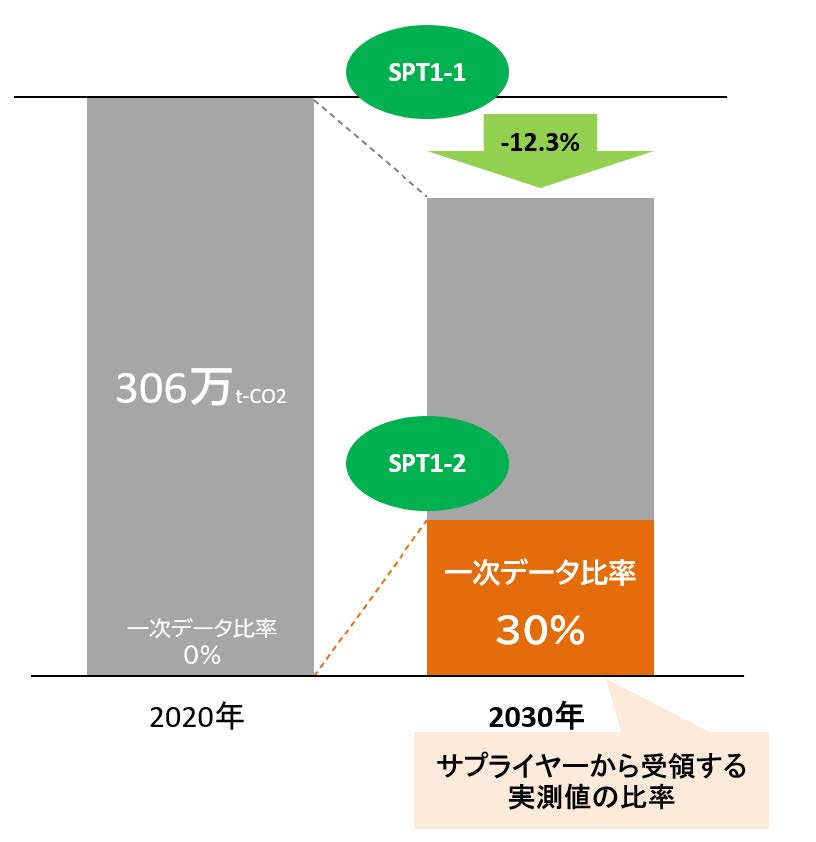

The Nagase Group has declared its commitment to achieving carbon neutrality by 2050, with the aim of reducing GHG emissions to zero (Scope 1 and 2), and by 2030, reducing Scope 1 and 2 emissions by 46% (compared to 2013) and Scope 3 emissions by at least 12.3% (compared to 2020). ※The Scope 3 target may be revised in the future after dialogue with the supply chain.

Commitment to SBT (Science Based Targets)

Nagase & Co., Ltd. has committed to set near-term company-wide emission reductions in line with climate science with the SBTi in September 2024. We will also review our goals for acquiring SBT certification.

NAGASE Group greenhouse gas emissions and Goals

Major Initiatives for 2024

In FY2024, we will further accelerate our initiatives aimed at achieving our materiality, “Realize a Decarbonization,”by committing to obtain SBT certification. Additionally, our energy efficiency improvement initiatives and increased use of renewable energy at each group company enabled us to surpass our ACE 2.0 targets.

| KPI | FY2024 | |

|---|---|---|

| Carbon Neutral | 【Consolidated】 Scope1,2 reduction rate:37% or more (compared to 2013) Reduction from renewable energy generation and purchase:35,000 tons or more (cumulative total) | 【Consolidated】Scope1,2 reduction rate:43% 【Consolidated】Reduction from renewable energy generation and purchase:13,272t (cumulative total) |

| 【Non-consolidated】Scope 2 Zero emissions | 【Non-consolidated】Scope 2:1,893t |

The NAGASE Group is a member of the Japan Foreign Trade Council. The NAGASE Group's approach to climate change is consistent with that of the Japan Foreign Trade Council, and the goals set by the Japan Foreign Trade Council are shared within the Environment ISO Secretariat.

Initiatives & Policymaker Engagement

Membership in organizations working on climate change issues

Japan Climate Initiative

The NAGASE Group is a member of the Japan Climate Initiative (JCI), which calls for "Joining the front line of the global push for decarbonization from Japan."

Japan Foreign Trade Council / Sustainability Promotion Committee

Our Company’s Representative Director, President and CEO serves as Executive Director of the Japan Foreign Trade Council. As a member of the Sustainability Promotion Committee, our Company participates in committee activities and promotes activities related to climate change and other issues.

Zero Emission Challenge

NAGASE & CO., LTD. is participating in the Ministry of Economy, Trade and Industry’s Zero Emission Challenge for the realization of 2050 carbon neutrality with the project Development of Production Technology for Bio-based Products to Accelerate Carbon Recycling.

Engagement with policymakers

The NAGASE Group is engaging with policymakers as shown below.

| Focus of the law | Corporate position | Specific details of the collaboration | Proposed legislative solutions | Mandatory carbon reporting | Support | More than 99% of the Scope 1 and Scope 2 emissions from the NAGASE Group come from within Japan. For this reason, the NAGASE Group is working with Japanese regulations. In accordance with the Act on Promotion of Global Warming Countermeasures ("Global Warming Countermeasures Act") and the Act on the Rationalization etc. of Energy Use ("Energy Saving Act"), both of which cover businesses in Japan, the NAGASE Group has been reducing greenhouse gas emissions and energy consumption, and reporting the amount of emissions and consumption. We support these laws and policymakers in implementing reduction activities and reporting appropriately. | Support without exception (laws and regulations concerning reduction of greenhouse gas emissions and energy consumption) |

|---|

In addition, we support the Japanese government's statement to reduce greenhouse gas emissions by 46% from the FY2013 level by 2030 and have established our Company target to manage greenhouse gas emissions from a long-term perspective.

Sustainability Finance

Issuance of Sustainability Linked Bonds

In June 2022, we issued our first Sustainability Linked Bond (*1) with the aim of contributing to solving social and environmental issues through our corporate activities.

Overview

| term of issue | 10 years |

|---|---|

| amount of issue | 10 billion yen |

| Publication Date | June 2022 |

| KPI | KPI 1:Greenhouse gas emissions of the Group (Scope 1 and 2) KPI 2:Greenhouse gas emissions of the Group (Scope 3) |

| SPTs (*2) | SPT 1:Reduce the Group's greenhouse gas emissions by 46% in FY2030 (compared to FY13) (Scope 1 and 2) SPT 2:Reduce the Group's greenhouse gas emissions by at least 12.3% in FY2030 (compared to FY2020) (Scope 3) |

| Bond Characteristics | SPTs will be established as SPT1 and SPT2. If it is confirmed that any of the SPTs have not been achieved as of the judgment date, emission credits (credits/certificates of CO2 reduction value) will be purchased in an amount corresponding to the achievement status of the SPTs before the redemption of the Bonds in order to accelerate efforts to address climate change. When emission credits are purchased, the name of the credits, the date of transfer, and the amount purchased will be disclosed in the integrated report or on the website. If SPT1 is not achieved, an amount equivalent to 0.10% of the bond issue amount will be purchased; if SPT2 is not achieved, an amount equivalent to 0.05% of the bond issue amount will be purchased. (If both SPTs are not achieved, a total amount equivalent to 0.15% will be purchased.) However, in the event of force majeure matters, etc. under the emission rights purchase agreement (e.g., changes in trading system rules and regulations, system failures related to the transfer of emission rights, etc.), the Company will provide public interest incorporated associations, public interest foundations, international organizations, local government authorized NPOs, local governments and similar organizations that are engaged in environmental conservation activities with an amount equivalent to the amount of the Bonds (For the amount of donation based on the achievement of SPTs, please refer to the description in the Emission Credits section above.) The final recipient of the donation will be determined by the institution after a close examination of the factors that led to the non-achievement of the SPTs. |

| lead manager | Nomura Securities (administration), Daiwa Securities Co. , Mizuho Securities Co., Ltd. |

| Structuring Agent (*3) | Nomura Securities Co. |

- *1 A Sustainability Linked Bond is a bond whose terms vary depending on whether or not it meets predetermined sustainability/ESG objectives. The issuer of a Sustainability Linked Bond commits to improving future sustainability outcomes within an initially defined time horizon. Specifically, the instrument is based on the issuer's assessment of future performance using predetermined Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs), and the terms of the bond change depending on whether the SPTs set as target values to be achieved with respect to the KPIs are achieved. The terms of the bond will vary depending on whether or not the target figures set to be achieved with respect to the KPIs are achieved.

- *2 Sustainability Performance Targets (SPTs) are targets based on the issuer's management strategy that determine the terms of issuance of Sustainability Linked Bonds.

- *3 A structuring agent is a person who assists in the implementation of a Sustainability Linked Bond by providing advice on the development of the Sustainability Linked Bond framework and obtaining a second party opinion.

For more information on Sustainability Link Bonds, please see

Independent Assessment of Sustainability Linked Bond Eligibilit

We have commissioned Rating and Investment Information, Inc. (R&I) to obtain a second party opinion on the credibility and environmental and social benefits of the Framework and its conformance with SLBP 2020.

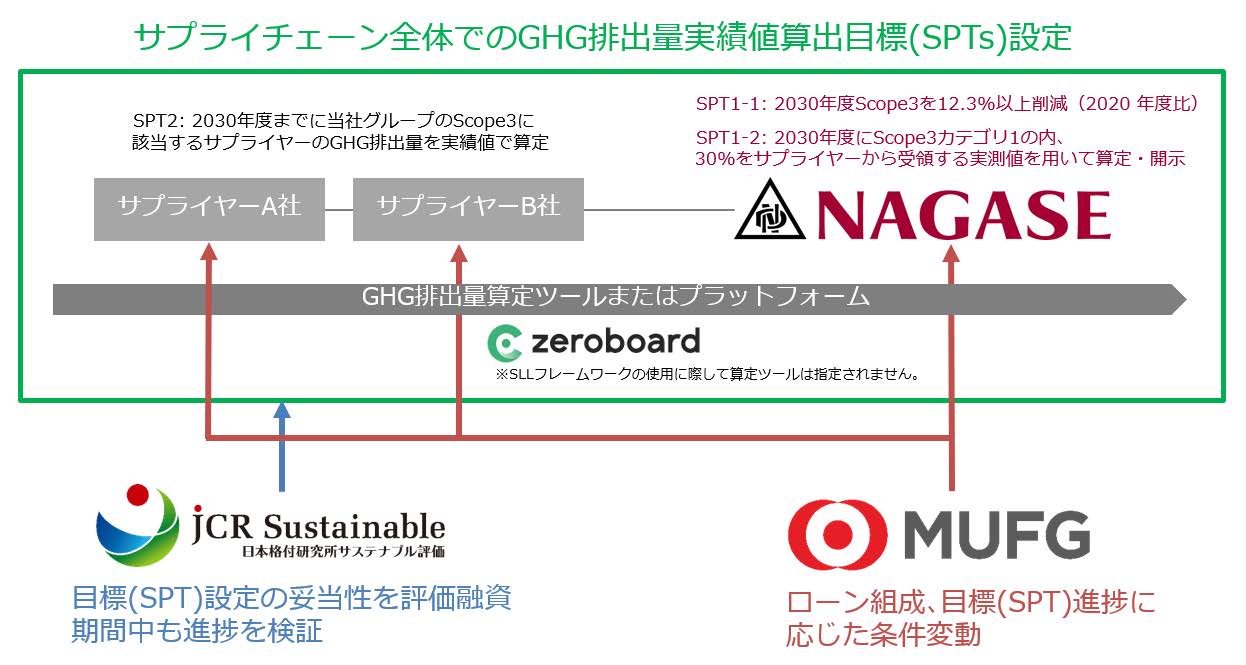

Sustainability Linked Loan

The Sustainability Linked Loan (SLL) (*1) framework developed by NAGASE & CO., LTD. and Mitsubishi UFJ Bank Limited has been selected by the Ministry of the Environment as a model case study for the 2022 Green Finance Model Case Study Creation Project (*2).

In addition, on October 28, 2024, Nagase & Co. concluded a sustainability-linked loan agreement utilizing this framework and procured 20 billion yen.

Framework Scheme

- *1 Loans that encourage borrowers to meet ambitious, pre-determined Sustainability Performance Targets (SPTs).

- *2 For model cases and project summaries of the FY2022 Green Finance Model Case Study Creation Project, please refer to the following Selection of Model Case Study for FY2022 Green Finance Model Case Study Creation Project (NAGASE & CO., LTD.)

Features of the Framework

・Adoption of primary data (*1) ratios of GHG emissions as Sustainability Performance Targets (SPTs)

・The framework is designed to enable not only the company itself but also its suppliers to borrow using the framework, so that the entire supply chain can visualize and reduce GHG emissions.

NAGASE Group's Scope 3 reduction targets and SPTs

- *1 ① obtained from the company itself or its suppliers, ② company-specific activity data, emissions, or emissions intensity.

For details of the Sustainability Link Loan Framework, please refer to the following

Independent Assessment of Sustainability Linked Loan Eligibility

Our Sustainability Linked Loan Framework has been confirmed by the Ministry of the Environment and its contractor, Japan Credit Rating Agency, Inc. to be compatible with the Green Loan and Sustainability Linked Loan Guidelines 2022 and the Sustainability Linked Loan Principles 2022.

Overview of Sustainability Linked Loan (October 28, 2024)

| Date of contract | October 28, 2024 |

|---|---|

| Arranger | Mitsubishi UFJ Bank, Ltd. |

| Amount funded | 20 billion yen |

| SPTs | SPT 1: Reduce the NAGASE Group's greenhouse gas emissions (Scope 3) in FY2030 by at least 12.3% compared to FY2020. SPT 2: Calculate and disclose at least 30% (on an emissions basis) of the NAGASE Group's greenhouse gas emissions in Scope 3 Category 1 in FY2030 using actual measurements received by the borrower from suppliers. |

Examples of initiatives

LCA Initiatives

Life Cycle Assessment (LCA) is a method to quantitatively evaluate the input resources, environmental impact, and potential environmental impact on the earth and the ecosystem of a product throughout its life cycle, from procurement of raw materials to production, distribution, use, and disposal. The NAGASE Group is promoting efforts to calculate environmental impact indicators such as CO2 emissions at the design stage through the calculation of LCA products.

Endorsement of the GX League Concept

NAGASE & CO., LTD. endorses the "GX League Basic Concept" announced by the Ministry of Economy, Trade and Industry (METI), which is a forum for companies actively engaged in Green Transformation (GX) to collaborate with government and academia to discuss reform of the entire economic and social system and to create new markets. GHX (Green Transformation) Minebea is committed to achieving carbon neutrality, which means virtually eliminating GHG emissions by 2050. The GX League will focus on the individual measures (1) "Visualization of emissions through the supply chain" and (3) "Provision of low-carbon products and reduction solutions, introduction of environmentally friendly equipment, etc." as its themes. The GX League will also use "zeroboard" as a tool for the promotion of the initiatives. In addition, the GX League will contribute to the achievement of the government's carbon neutrality target by providing support for CFP (Scope 3) calculations on an organizational basis using "zeroboard" and conducting CFP calculation trials on a product-by-product basis in collaboration with an IT company.

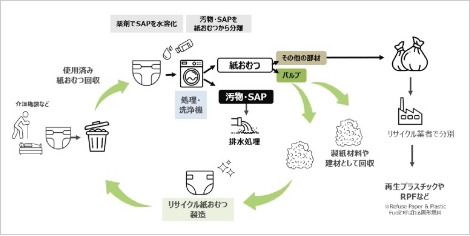

Joint Development of Bio-SAP for Adult Diapers

NAGASE & CO., NAGASE CHEMTEX, and Hayashibara (now NAGASE VIITA) have jointly succeeded in developing a highly bio-based superabsorbent polymer (SAP) with a higher proportion of bio-derived raw materials, while maintaining the same or better water absorption performance (*1) as conventional products.

In May 2024, the three companies, Livdo Corporation, Nagase & Co. and Nagase ChemteX Corporation, signed a joint development agreement for the use of this superabsorbent polymer (SAP) in adult diapers and urine care products, with the aim of commercializing the products from 2027 onwards.

In Japan, the consumption of adult diapers is increasing due to the growing population of people aged 65 and over. The use of diapers requires the use of a fuel additive depending on the amount of moisture in the urine, etc., and the increase in CO2 emissions during disposal and incineration is becoming a problem. This joint development is expected to lead to the resolution of the problem of residual gel-type SAP in the “acceptance of disposable diapers in sewage systems” advocated by the Ministry of Land, Infrastructure, Transport and Tourism, and to the promotion of the recycling of disposable diapers (*3) promoted by the Ministry of the Environment, by enabling the separation of disposable diapers and gel-type SAP.

Through this joint development, we aim to enable the wastewater treatment of used sanitary products, and to contribute to the reduction of CO2 emissions from incineration and to the reduction of the labor burden at the time of disposal.

*1 The water absorption performance of saline solution has been confirmed to be superior to that of the product developed here.

*2 From the Ministry of the Environment's “Guidelines for the Recycling of Used Diapers(pdf:2.3MB)”

*3 Water and Sewage: Realizing the Acceptance of Diapers in Sewage Systems - Ministry of Land, Infrastructure, Transport and Tourism