- Basic Approach to Corporate Governance

- Skills Matrix

- Corporate Governance System

- Internal Controls

- Compensation

- Audit System

- Outside Officers

- Board of Directors Effectiveness Evaluation

- Policies Related to Information Disclosure

- Timely Disclosure System

- Group Tax Policy

- Information Dissemination and Communication to Shareholders and Investors

Basic Approach to Corporate Governance

We recognize our responsibility to society and offer beneficial products and services while maintaining the highest standards of integrity. Through our growth, we will contribute to society and enrich the lives of our employees.

Based on this philosophy, we created the NAGASE Vision, which is a promise to our stakeholders that each of us will embody our value proposition to Identify, Develop and Expand to realize a safe, secure, and humane world where people live with peace of mind, engaging in measures to improve corporate value over the medium and long term.

We believe that rapid decision-making, execution, and transparency are essential for us to accomplish these initiatives as we engage in strengthening our corporate governance.

Board of Directors & Executive Officers

Basic Policy on the composition of the Board of Directors

The basic policy of the Board of Directors is to consist of internal directors with business experience, knowledge, and expertise, and external directors who can raise issues based on the perspectives of stakeholders and society, so that the Board of Directors can appropriately understand the status of business execution, make decisions flexibly and promptly, and supervise the status of execution.

Under this basic policy, the Board of Directors currently consists of nine members, including three external directors who are independent officers. More than a third of the Board of Directors is composed of independent external directors. In addition, the Company promotes diversity in management regardless of gender, nationality, and race, and we believe that we have secured a certain level of diversity in terms of gender and internationality, as we have appointed one female director, and many directors have experienced working overseas for several years (average number of years of working overseas for internal directors: about six years).

At present, we believe that we are able to achieve both a certain level of diversity and an appropriate size of the Board of Directors. However, in order to ensure the effectiveness of the Board of Directors, we will aim to further improve the composition of the Board of Directors to achieve both diversity, including gender, and an appropriate size.

Skills Matrix

The Company has identified the skills required by the Board of Directors and disclosed the roles and expertise specifically expected of directors and auditors as follows.

| Position in the Company Name |

Corporate Management | Global Business | Marketing / Sales | R&D | Production/Quality | Finance and accounting | Legal affairs / Risk management | Human Resource Management | Sustainability | DX |

|---|---|---|---|---|---|---|---|---|---|---|

| Representative Director, Chairman Kenji Asakura |

〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Representative Director, President and CEO Hiroyuki Ueshima |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||

| Director Masatoshi Kamada |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Director Tamotsu Isobe |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Director Yoshihisa Shimizu |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Director, Senior Adviser Hiroshi Nagase |

〇 | 〇 | 〇 | |||||||

| Outside Director Ritsuko Nonomiya |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Outside Director Noriaki Horikiri |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Outside Director Toshiaki Mikoshiba |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Outside Audit & Supervisory Board Member Masaya Ishida |

〇 | 〇 | ||||||||

| Audit & Supervisory Board Member Akira Takami |

〇 | 〇 | ||||||||

| Audit & Supervisory Board Member Takanori Yamauchi |

〇 | 〇 | ||||||||

| Outside Audit & Supervisory Board Member (part-time) Gan Matsui |

〇 | 〇 | 〇 |

As of June 18, 2025

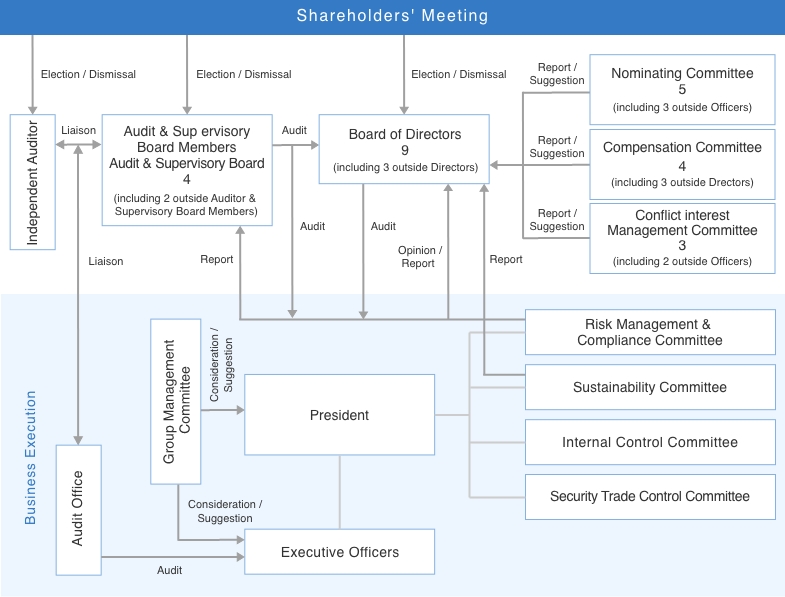

Corporate Governance System

| Board of Directors | The Board of Directors is clearly positioned as the body in charge of making decisions on management policies and strategies, and supervises the execution of operations. It holds a regular monthly meeting to make important decisions, track business performance and formulate measures. |

|---|---|

| Audit & Supervisory Board/Audit & Supervisory Board Members | In accordance with the audit policy and audit plans set at Audit & Supervisory Board meetings, Audit & Supervisory Board members conduct audits of the execution of duties by directors by attending important meetings such as Board of Directors meetings and receiving reports solicited from subsidiaries on an as-needed basis. |

| Nomination Committee | The Nomination Committee has five members, the majority being outside directors. It deliberates on appointment proposals for directors and executive officers and succession plans for the Chief Executive Officer. It then provides reports and recommendations to the Board of Directors with the aim of ensuring objectivity and transparency in nominations of NAGASE’s top management. |

| Compensation Committee | The Compensation Committee has four members, the majority being outside directors. It enhances the objectivity and transparency of the decisionmaking process regarding compensation of directors and executive officers by screening the appropriateness of every compensation level and the compensation system to report and make recommendations to the Board of Directors. |

Attendance of Directors and Corporate Auditors at Board of Directors Meetings in FY2024

- ※The number of meetings of the Board of Directors does not include resolutions adopted in writing. The number of the Board/the Audit & Supervisory Board meetings in the attendance of Tamotsu Isobe and Masaya Ishida at the Board of Directors / the Audit & Supervisory Board meetings are the number of meetings held since they became a director/a corporate auditor, respectively.

- ※Masanori Furukawa retired from his position at the Annual General Meeting of Shareholders in June 2025.

Resolutions adopted or reported at Board of Directors meetings and the number of items on the agenda(FY2024)

| Classification | Number of meetings |

|---|---|

| Management Strategy, Sustainability and Governance | 14 |

| Financial Results and Financial Affairs 32 | 36 |

| Risk management, internal control and compliance related | 10 |

| Human Resources | 7 |

| Individual case | 26 |

| Total amount | 93 |

| Group Management Committee | The Group Management Committee comprises executive officers appointed by the Board of Directors, and in principle, meets regularly twice a month to discuss management strategies, investment projects, and other important matters to support business decision-making. This committee serves as an advisory body that discusses matters resolved by the Board of Directors. |

|---|---|

| Risk Management & Compliance Committee | The Risk Management & Compliance Committee establishes and strengthens risk management and compliance systems that cover not only legal compliance with also corporate ethics, ESG Risks. Risks related to the business operations of the NAGASE Group and regular supervision of the effectiveness of the management system are managed by the Risk Management and Compliance Committee under the supervision of the Board of Directors. |

| Sustainability Committee | The Sustainability Committee is chaired by the President with executive officers and senior management of Group companies as members. This committee formulates policies for promoting sustainability throughout the Group, establishes and maintains the promotion system, monitors measures, and conducts educational activities within the Group. |

| Internal Control Committee | The Committee deliberates on basic policies for the internal control system, builds frameworks established by the internal control system, and monitors the management of the frameworks to ensure the appropriateness of business operations. |

| Security Trade Control Committee | The Security Trade Control Committee ensures compliance with export-related laws and regulations in relation to foreign currency exchange and foreign trade for the Company’s trading of cargoes and technologies covered by such laws and regulations. |

As described above, the current corporate governance system, functioning in cooperation between outside directors, the Audit & Supervisory Board, and various committees with the aim of strengthening the Group's corporate governance function, acts in a supervisory and audit function from multifaceted perspectives, including from outside the company. At present, we have determined that this is the most reasonable system to realize this.

Corporate Governance System

Internal Controls

The NAGASE Group established an internal control system to build a stable and sustainable corporate foundation for the Group with the aim of enhancing corporate value through corporate activities. In line with the Management Philosophy of maintaining highest integrity, the internal controls of the NAGASE Group monitor the construction and operation of frameworks defined under the internal control system and ensures the propriety of operations.

Status of Internal Controls Systems

a) Systems to ensure that Directors and employees execute their duties in accordance with laws and regulations and the Articles of Incorporation

b) Systems for retaining and managing information relating to the execution of duties by Directors

c) Rules relating to management of loss-related risks and other systems

d) Systems for ensuring the efficient execution of duties by Directors

e) Systems for ensuring the proper implementation of business by the corporate group comprising a stock corporation and its subsidiaries

f) Matters pertaining to employees when Audit & Supervisory Board members request the appointment of employees to assist them in the execution of their duties

g) Matters pertaining to ensuring the independence of employees specified in the preceding paragraph from Directors and ensuring the effectiveness of instructions from Audit & Supervisory Board members

h) Systems for Directors and employees to report to Audit & Supervisory Board members and other systems for reporting to Audit & Supervisory Board members

i) Other systems to ensure that audits are conducted effectively by Audit & Supervisory Board members

j) Matters concerning procedures for prepayment or reimbursement of expenses incurred in connection with the performance of duties by Corporate Auditors and other expenses or liabilities incurred in connection with the performance of such duties. Matters related to the policy for the treatment of expenses or liabilities that arise in the performance of duties of the Corporate Auditors

k) Other systems to ensure that audits by corporate auditors are conducted effectively

Details

Compensation

Policy for Determining Level of Compensation

The Company has determine d its policy on the amounts and calculation methods of director remuneration based on recommendations from the Compensation Committee, which consists of a majority of outside directors, and deliberations by the Board of Directors. The basic policy aims to ( i) align director interests with shareholder value, (ii) enhance incentives to improve both short and medium term performance and corporate value, (iii) ensure externally competitive compensation levels, and (iv) establish a transparent and objective remu neration system and decision making process. To strengthen the incentive effect for improving performance and corporate value one of the core principles of the policy the proportion of variable remuneration for executive directors is set between 40% and 67% of total remuneration, assuming 100% achiev ement of performance targets. Within this, monetary performance linked remuneration accounts for 27% to 33% of total remuneration at standard levels. It is paid annually at the end of June and uses operating profit as the performance indicato r to incentivi ze annual business performance.

Non monetary remuneration accounts for 13% to 33% of total remuneration and is designed to promote sustainable corporate value and alignment with shareholder interests. The Company has introduced a performance linked stock compensation plan and a restricted stock compensation plan. The performance linked stock compensation plan uses ROE and sustainability related indicators as evaluation metrics. The ratio betw een performance linked stock compensation and restricted stock compensation is set at 1:1, assuming 100% achievement of performance targets.

Furthermore, following approval at the Annual General Meeting of Shareholders held on June 18, 2025, regarding the “Amendment to the Performance Linked Stock Compensation Plan for Directors” and the “Revision of the Maximum Remuneration Amount for Director s,” the Company has revised its policy on the amounts and calculation methods of director remuneration.

In order to strengthen the linkage between sustainability-related initiatives and executive compensation, ESG-related indicators (Currently Sustainability-related indicators) will be added to the performance-linked indicators beginning in FY2024.

Method for determining the policy for determining the compensation of individual Directors

"The Company determines the policy for determining the amount of compensation of Directors and the calculation method thereof through consultation with the Compensation Committee, the majority of which is made up of Outside Directors, and deliberation at the Board of Directors. The basic policy is to promote linkage with shareholder value, increase the incentive effect for improving business performance and corporate value in both the short and medium term, achieve a compensation level that is externally competitive, and have a more transparent and objective system and compensation decision-making process. In addition, the compensation of Outside Directors and Auditors is limited to basic compensation, which is fixed compensation, in consideration of the nature of their duties."

Summary of the policy for determining the compensation of individual Directors

<Basic principles of the Compensation System>

The NAGASE Group is committed to solving manufacturing issues through materials, building on the relationships of trust with stakeholders fostered through activities conducted with the highest standards of integrity. The Group aims to contribute to business not only in the short term but also over the medium to long term, pursuing the realization of a sustainable world where people live with peace of mind in an era where economic value and social value are increasingly intertwined. NAGASE newly established the following policy regarding the compensation of internal Directors and executive officers, who serve as the driving force behind achieving these goals. Based on this policy, the Company designed a specific compensation system.

| Earning and corporate value enhancement |

・Offer conpensation system that drives the achievement of the following strategies and supports sustainable corpotrate value creation - Linking compensation to shareholder value - Pursing short-term and medium- to long-term growth and efficiency - Balancing economic and social value |

|---|---|

| Recruitment and retention of skilled human capital |

・Offer competitive compensation system and compensation levels to attract and retain diverse. Skilled human capital capable of accelerating businss transformation ・Offer compensation levels that encourage the grouth and development of the next generation of management leaders |

| Ensuring accountability | ・Maintain a transparent and objective compensation system and compensation-determining process |

<Compensation level and compensation structure>

The Company uses objective external compensation data to benchmark NAGASE against competitive domestic companies in both business operations and talent acquisition. NAGASE sets its compensation levels at or above the market median of such data, taking into account business conditions and other relevant factors. In doing so, NAGASE aims to attract and retain diverse, skilled human capital capable of accelerating business transformation and to foster the growth ambition of the next generation of management leaders.

| Type of compensation (approximate ratio) |

Purpose | Performance metrics | Evaluation period | Details | ||

|---|---|---|---|---|---|---|

| Basic compensation (33-59%) |

Fixed | Badic compensation for execution of duties | ー | ー | Monthly payment determined by the board of Directors in accordance with roles and responsibilities. | |

| Annual bonus (27-33%) |

Variable | Incentivize improvement in annual business performance | ・Consolidated operating income ・Business division operating income (for Directors in charge of business divisions) |

1 year |

Determined by a formula resolved by the Board of Directors following deliberation by the Officer Remuneration Committee, based on consolidated operating income and business division operating income for the fisical year. Paid in a lump sum in June. |

|

| Individual performance evaluations |

The president, delegated by the Board of Directors, evaluates individual officer performance and determines individual payment amouts (the President is not subject to individual evaluation). Paid in a lump sum in June. |

|||||

| Stock-based compensation *1 (13-33%) |

Performance-linked stocke compensation | Incentivize sustainable grouth in corpotrate value | ・ROE ・Sustainability related indicators |

3 year *2 | Stock grant points granted annually based on achievement of medium-term KPIs over three consecutive fisical years and determined by a formula resolved by the Board of Directors following deliberation by the Officer Remuneration Committee (with a three-year transfer restriction after grant.)*3 | |

| Restricted stock compensation | Align interest with shareholder value | ー | ー | Restricted stock granted annually based on a standard ampunt resolved by the Board of Directors according to role and responsibility, with transfer restrictions lifted upon resignation. | ||

The indicated ratios show the proportion of each compensation type, assuming 100% achievement of performance targets based on the standard value. Director, senior adviser not eligible for stock-based compensation are excluded.

- *1. Stock-based compensation will be provided in a trust.

- *2. However, the Company will evaluate fiscal 2025, the final year of the current medium-term management plan, based on a single fiscal year.

- *3. Transfer restrictions are lifted upon resignation in the event that an officer retires during the three-year period.

Compensation paid to directors and members of the Audit & Supervisory Board in service as of the fiscal year ended March 2025

The Company paid ¥481 million in compensation to 9 directors and ¥84 million in compensation to 5 members of the Audit & Supervisor Board. Of this amount, a total of ¥75 million in compensation was paid to six outside officers. Payments to directors include in the amount of ¥249 million for the year ended March 2025, recognized as an expense for the period.

In addition, the Company paid the equivalent of ¥25 million as employee bonuses for individuals serving concurrently as directors and employees. The aforementioned compensation includes payments to one Audit & Supervisor Board who retired upon the conclusion of the 109th regular shareholders’ meeting held June 21, 2024.

Breakdown of Compensation and Total Amounts(Fiscal year ended March 2025)

Important Matters regarding Employee Bonuses for Employees Also Serving as Directors(Fiscal year ended March 2025)

| Total Compensation (Millions of yen) |

Number of Eligible Directors | Comments |

|---|---|---|

| 25 | 2 | Paid in an amount equivalent to employee bonus. |

Addition of Sustainability-related indicators to performance-linked compensation

In recent years, there has been a shift from a “trade-off” mentality, in which social value and economic value are incompatible, to a “trade-on” mentality, in which social and especially environmental considerations are a prerequisite for economic value. As Nagase moves forward with corporate activities based on this “trade-on” approach, we added ESG-related indicators (Currently Sustainability-related indicators) to our performance-linked indicators from FY2024 in order to strengthen the linkage between our sustainability-related initiatives and executive compensation.

<Sustainability-related Indicators Evaluation Indicator>

①Employee engagement

②Carbon neutral

③External evaluation

※We will set appropriate evaluation indicators depending on the status of material issues and materiality at our company.

Audit System

Status of Audit by Audit & Supervisory Board Members

Audits by corporate auditors are conducted by three full-time corporate auditors (including one outside corporate auditor) and one non-full-time corporate auditor (outside corporate auditor), for a total of four corporate auditors, including corporate auditors with considerable financial and accounting knowledge.

The Board of Corporate Auditors meets once a month in principle and as needed. Each Corporate Auditor reports on audit activities and results, and exchanges various opinions regarding audit perspectives and opinions.

In addition, in order to ensure the effectiveness of audits by corporate auditors, the Company has appointed one corporate auditor staff member with considerable knowledge of finance, accounting and internal auditing from among the members of the Audit Office, which is the internal auditing department of the Company.

Status of Audit by Internal Auditors

The internal audit is conducted by 11 employees, including certified internal auditors (CIA) and qualified internal auditors (QIA) with expert opinions on internal auditing, who audit the appropriateness and efficiency of the business activities of the Company and its subsidiaries in accordance with the internal audit rules.

Status of Audit by Independent Auditor

Independent audits are performed in a fair and impartial manner by the following specified limited liability partners.

| Certified Public Accountants | Auditing Firm | |

|---|---|---|

| Specified limited liability partners Managing partners |

Eri Sekiguchi | Ernst & Young ShinNihon LLC |

| Takuya Suzuki | ||

Neither of the certified public accountants, who have executed the aforementioned duties, have performed audits continuously for more than seven years.

Outside Officers

Through participation in the Board of Directors, outside directors receive reports on the implementation plans of audits by the auditors, the results of audits by the auditors and the accounting auditor, the evaluation results of the Company relating to the internal control in accordance with the Financial Commodity Exchange Act, and the status of the development and operation of the internal control system, etc. in accordance with the Companies Act.

Outside auditors exchange information on internal audits and audits of domestic and overseas affiliates at the Audit & Supervisory Board, and receive reports on audit results from corporate auditors and exchange opinions. In addition, the outside auditors receive a direct explanation of an audit plan and results from the accounting auditor, exchange opinions on risk recognition, and receive reports on the status of the accounting auditor's execution of duties from the full-time auditors.

In addition, outside directors and the Audit & Supervisory Board members exchange opinions through regular meetings.

Outside Director

NAGASE has three outside directors, Ms. Ritsuko Nonomiya, Mr. Noriaki Horikiri and Mr. Toshiaki Mikoshiba. All three are independent outside directors based on the definition set forth by the Financial Instruments Exchange.

| Name | Reasons of Appointment |

|---|---|

|

Ms. Ritsuko Nonomiya Assumed office in June 2020 < Attendance at Board of Director meetings in fiscal 2024 > 17/17 (100%) |

Ms. Ritsuko Nonomiya has a high level of financial and accounting knowledge as well as sufficient insight and experience in corporate management through her experience in auditing and other operations at KPMG Group and her involvement in M&A and business development at UBS Group and GE Group. She is appointed as an outside director because She is expected to strengthen the corporate governance of our Group, which is increasing its overseas ratio, by making use of her knowledge and experience and by offering suggestions on the overall management of our company. She has no personal, capital, or business relationships or other interests with the Company, except for her shareholding in the Company's stock, and is therefore considered an outside director with no potential conflicts of interest with general shareholders. |

|

Mr. Noriaki Horikiri Assumed office in June 2022 < Attendance at Board of Director meetings in fiscal 2024 > 17/17 (100%) |

Mr. Noriaki Horikiri has long been involved in the management of Kikkoman Corporation and has a high degree of insight and a wealth of experience in corporate management. We have elected him as an outside director because we expect that he will make use of this experience to make recommendations regarding our overall management, including overseas development and production activities, and thereby strengthen the corporate governance of the Group. He is the Representative Director, Chairman and CEO of Kikkoman Corporation, and although the Company has transactions with Kikkoman Corporation, there is no materiality that would give rise to a special interest relationship in light of the size of the transactions. Other than the above, there is no personal, capital, business, or other relationship of interest with the Company, except for the Company's shareholding, and therefore, the Company recognizes that the Outside Director is an Outside Director who is unlikely to have any conflict of interest with general shareholders. |

|

Mr. Toshiaki Mikoshiba Assumed office in June 2023 < Attendance at Board of Director meetings in fiscal 2024 > 17/17 (100%) |

Mr. Toshiaki Mikoshiba has long been involved in the management of Honda Motor Co., Ltd. for many years and has a high degree of insight and a wealth of experience in corporate management. We have elected him as an outside director because we expect that he will strengthen the corporate governance of our group by making use of his expertise to make proposals regarding our overall management, including overseas development and sales. He has served as Chairman of the Board of Directors of Honda Motor Co., Ltd. in the past, and although the Company has transactions with the company, there is nothing of importance that would give rise to a special interest relationship, given the size of the transactions. In addition to the above, there are no personal, capital, business, or other relationships of interest with the Company, and therefore, the Company recognizes him as an outside director who is unlikely to have any conflicts of interest with general shareholders. |

Details (Outside Directors’ Relationship with the Company)

Outside Auditors

Our outside auditors are Masaya Ishida and Iwao Matsui, both of whom are independent officers as defined by the rules of the financial instruments exchange.

| Name | Reasons of Appointment |

|---|---|

|

Mr. Masaya Ishida Assumed office in June 2024 < Attendance in fiscal 2024 > Board of Directors meetings: 13/13 (100%) Audit & Supervisory Board meetings: 13/13 (100%) |

Mr. Masaya Ishida has considerable knowledge of finance and accounting based on his long and broad experience at financial institutions in Japan and overseas.He has worked for Sumitomo Mitsui Banking Corporation, our correspondent bank, in the past.However, We has a sound financial structure with a high capital adequacy ratio, is not dependent on borrowing from financial institutions, and the degree of influence of financial institutions on the Company's management is minimal, and the Company has determined that there is no materiality that would give rise to a special interest relationship. Other than the above, there are no personal, capital, business, or other relationships of interest with the Company, and therefore, the Company recognizes him as an outside corporate auditor who is unlikely to have any conflicts of interest with general shareholders. |

|

Mr. Gan Matsui Assumed office in June 2018 < Attendance in fiscal 2024 > Board of Directors meetings: 17/17 (100%) Audit & Supervisory Board meetings: 17/17 (100%) |

Mr. Gan Matsui has a wealth of experience and insight in the legal profession. And his insightful knowledge, we believe that he will be able to appropriately perform his duties as an outside corporate auditor. Therefore, he is considered to be an outside corporate auditor who is not likely to have a conflict of interest with general shareholders. |

Details (Outside Directors’ Relationship with the Company)

Criteria for appointment of external officers

The candidate for external director is a person who can raise issues based on his or her honest personality, high insight and ability, and the perspectives of stakeholders and society. The Representative Director selects those candidates, and after deliberation by the independent Nominating Committee, the Board of Directors deliberates and makes a resolution, which is then submitted to the Shareholders’ Meeting.

With regard to audit and supervisory board members, the Representative Director selects candidates from among those who meet the requirements set forth in the Corporate Auditor Auditing Standards, and after prior consultation with the Audit and Supervisory Board and obtaining their consent, the Board of Directors deliberates and makes a resolution, and the matter is submitted to the Shareholders’ Meeting. In addition, our Company discloses the reasons for the nomination of each candidate for director and each candidate for audit and supervisory board member in the reference documents of the Notice of Convocation of the Shareholders’ Meeting.

Directors' own transactions and transactions with conflicts of interest

The regulations of the Board of Directors stipulate that directors or executive officers must obtain the approval of the Board of Directors in the event that they engage in own transactions or transactions with conflicts of interest.

Directors' compensation and shareholder voting rights

The Company's Articles of Incorporation stipulate that the total amount of remuneration for Directors, etc. shall be determined by a resolution of the Shareholders’ Meeting.

Board of Directors Effectiveness Evaluation

[Board of Directors Effectiveness Evaluation]

The Company believes that it is important to analyze and evaluate the effectiveness of the Board of Directors every year to enhance its effectiveness. For this reason, we conduct a questionnaire survey of all directors and audit and supervisory board members, and analyze and evaluate the results at the Board of Directors. The results are summarized in the Corporate Governance Report every year. The results for the fiscal year ended March 2021 are disclosed in Supplementary Principle 4 -11 (3) in “Disclosure Based on the Principles of the Corporate Governance Code” of this report.

[Summary of Effectiveness Evaluation Results]

As a result, the Company confirmed that our Board of Directors conducts appropriate and timely deliberations and decision-making, functioning effectively.

Furthermore, in response to the requirement to further expand deliberations on medium- to long-term management policies, company-wide strategies and important matters identified in the evaluation from the previous year's Board of Directors' meeting, we carried out a review of resolutions of the Board of Directors and made improvements.

At the same time, from the perspective of further improvement of effectiveness, we confirmed the issues that need to be addressed in order to optimize the provision of information in the preliminary examination to make the deliberations more effective, to expand feedback and follow-up, and to ensure diversity in the composition of the Board of Directors over the medium and long term.

The Company intends to continue with initiatives for improving the effectiveness of the Board of Directors.

Policies Related to Information Disclosure

Pursuant to the NAGASE Group Code of Conduct for Risk Management & Compliance, we engage in ongoing communications with society and our stakeholders through timely disclosure of truly important information over appropriate channels. We are mindful that all corporate activities remain within the bounds of socially accepted norms.

This basic philosophy guides us as we conduct timely, appropriate, and fair disclosure of information through investor relations activities, public relations programs, and websites for our shareholders and investors to improve management transparency and accountability.

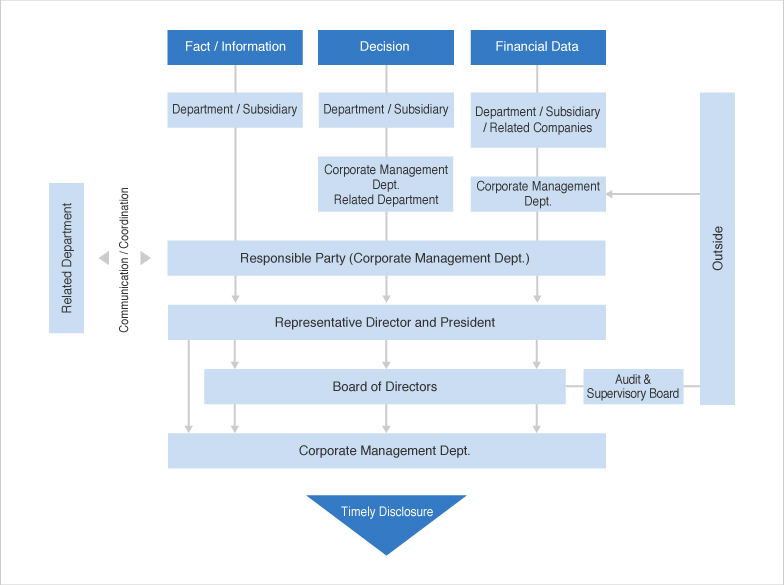

Timely Disclosure System

The Company has established Basic Compliance Policy. In pursuit of compliance with laws, regulations, and internal regulations/rules and public disclosure to stakeholders (interested parties), the company actively and fairly discloses corporate information striving to ensure transparency.

Under this basic approach, the company has created the following structure for identifying and managing information subject to timely disclosure which functions as an internal system for providing me timely and appropriate disclosure of company information to investors.

■ Information Related to Material Facts

The relevant headquarters general managers and division managers report information collected from departments and subsidiaries to the individual designated to handle such information. The individual designated to handle information coordinates with the relevant internal departments, summarizes information, and submits a report to the representative director and president.As necessary, a report is submitted to the board of directors, after which the Corporate Management Department (body responsible for timely disclosures) promptly issues a timely disclosure.

■ Information Related to Decision-Supporting Facts

Each department or subsidiary circulates a proposal draft, based on which the Corporate Management Department and related departments hold consultations. After a decision by the president, the board of directors makes a final approval, after which the Corporate Management Department promptly issues a timely disclosure.

■ Financial Information

The Corporate Management Departments receive financial information from each consolidated subsidiary, accepting advice and guidance from members of the Audit & Supervisory Board and outside experts as necessary to ensure the reliability of financial information received. These divisions then prepare financial reports and drafts of public announcements. After decision by the president, the board of directors makes a final approval, after which the Corporate Management Department promptly issues a timely disclosure.

Group Tax Policy

The NAGASE Group has established a Group Tax Policy.

Group Tax Policy

Background and Objectives

In accordance with its management philosophy, the NAGASE Group has established a Basic Compliance Policy to ensure that it complies with laws and rules, does not deviate from social norms, and engages in honest and fair corporate activities. As a multinational corporation, we conduct our business activities on a global scale and aim for further development as a global company by operating in accordance with international rules.

In accordance with the above philosophy, it is necessary to comply with the tax laws of each country and minimize tax risks. At the same time, to maximize shareholder value, it is necessary to establish a system to regularly check the tax positions of NAGASE Group companies on a global basis and reduce unnecessary tax expenses such as double taxation and apply the tax incentives. In order to achieve the above objectives, a global tax policy applicable to the NAGASE Group will be established.

1. Compliance with tax laws

The NAGASE Group complies with applicable tax laws and regulations, and conducts its business activities in accordance with standards published by international organizations (e.g., OECD Guidelines).

It is obligatory to pay the taxes set in each country on the set due date.

2. Minimize tax risk

In order to maximize shareholder value, the NAGASE Group will respond to changes in taxation systems and tax administration in each country and aim to minimize tax risks.

3. Maximize consolidated free cash flow

The NAGASE Group's tax organization advises each business unit and management on measures and schemes to optimize tax and tax-related expenses in order to achieve management objectives, based on the perspectives of 1 and 2 above. We aim to maximize after-tax profit, ROE, EPS, free cash flow, and ultimately shareholder value.

4. Part of business activities (structuring and planning)

Business considerations can lead to a decrease in business value if taxes are not taken into account. Tax considerations are an integral part of sustainable business growth. All planning has a business purpose and is not done solely for tax purposes.

In accordance with the spirit of domestic and international law, the NAGASE Group will not avoid taxes through the application of organizational forms or tax benefits that are not consistent with its business purposes or actual conditions. We do not utilize tax havens for the purpose of tax avoidance.

5. Tax Liability and Structure

The NAGASE Group's director in charge of tax management is the Chief Financial Officer (CFO). Tax issues arising from day-to-day business activities will be handled by the tax staff of each Group company in accordance with the Tax Guidelines, Group Tax Regulations, and other guidelines that stipulate the procedures for handling tax issues. Any issues raised during tax audits or significant issues related to tax risks will be reported by the tax staff of each Group company to the head office tax staff and the director in charge of administration, who will work together to consider measures to deal with such issues as necessary.

6. Relationship with Tax Authorities

The NAGASE Group will follow the tax administration and collection procedures, etc. of each country. If a tax audit is requested, we will disclose information to the authorities in a timely and appropriate manner and respond and cooperate with them in good faith, thereby building a relationship of trust. On the other hand, if there is a difference of opinion on a tax position, we will appropriately respond to and resolve any unreasonable claims in accordance with the legal principle of taxation. We maintain sound and normal relationships with tax authorities and do not provide unfair advantages.

7. Transfer Pricing

The NAGASE Group will consider arm's length pricing for foreign affiliate transactions and will allocate profits appropriately based on an analysis of the functions, risks, and assets between countries and between each subsidiary in proportion to their contributions. If the use of an Advance Pricing Agreement (APA) is appropriate, NAGASE Group will consult with the tax authorities in the relevant jurisdictions in advance. We will take appropriate documentation measures in accordance with the laws and regulations of each country.

8. Elimination of double taxation

In order to eliminate double taxation, where the same economic benefit is taxed in more than one country, tax treaties are applied between countries in which the business operates.

9. Tax Haven Tax Compliance

When investing in countries with low tax rate or when tax rates are reduced due to revisions of laws and regulations in each country, the NAGASE Group determines whether the anti-tax haven system is applicable in accordance with the tax laws and regulations.

As a result, if it is subject to anti-tax haven taxation, NAGASE Group will file a tax return and pay taxes appropriately.

10. Uncertain tax positions and tax interpretations

For cases where taxation relationships and tax positions are unclear, we will conduct risk assessments for each case and handle them appropriately. Our goal is to maintain shareholder value by ensuring proper tax payment through compliance with laws and regulations, and we aim to keep tax risks low. We seek advice from tax consultants or consult with tax authorities in each country or region in advance to reduce uncertainties and handle uncertain tax positions.

Information Dissemination and Communication to Shareholders and Investors

Communication with Analysts and Institutional Investors

By providing briefings on medium-term management plans and financial results, we offer forums where analysts and institutional investors can directly interact with management. Briefing session materials are published both in Japanese and English. In addition, members of management, including the President, regularly visit institutional investors and engage in active dialogue.

Communication with Individual Investors and Shareholders

In order to help outside parties gain an understanding of the NAGASE Group, we have set up a subsection of the investor relations section of our website, called “Individual Investors.” In addition, we hold briefings for individual investors to provide an easy-to-understand introduction of our global business activities, as well as NAGASE Group management strategies and performance reports.