CFO Message

Enhancing Capital Efficiency and Achieving a Sustainable Corporate Structure

Review of Fiscal 2020 and Outlook for Fiscal 2021

I would like to open this message by summarizing the highlights of the fiscal year ended March 31, 2021. The NAGASE Group experienced a downturn in coating raw materials, plastics, automotive components and certain other products both in Japan and overseas. This downturn was caused by the sizable impact of the COVID‑19 pandemic on the automobile industry, which is involved with many different businesses of the Group. Meanwhile, from the second quarter onward, electronics and plastics businesses performed favorably against the backdrop of working from home and stay‑at‑home demands. Combining these factors with rising health awareness, pharmaceutical‑ and food ingredient‑related business trended firmly.

Risks and Opportunities

Closely Monitoring Semiconductor and Food Ingredients‑Related Businesses

The NAGASE Group’s business has been increasingly exposed to geopolitical risk, with overseas sales currently surpassing 50% of net sales. We are closely monitoring the whereabout of the semiconductor regulated business, which is susceptible to the ebb and flow of the U.S.‑China trade conflict, and the food ingredients‑related business, which is highly reliant on Chinese products. Moreover, we believe that trends in society such as environmental measures and changes in the industrial structure in the automobile‑related and chemical and resin businesses could present risks

However, risk factors naturally harbor the possibility of being transformed into opportunities. For example, in the automobile‑related business, where the semiconductor shortage is causing concerns over a contraction in production, the Group has business foundations both in the U.S. and China, and we believe that we can achieve robust overall growth in these countries. We will not simply look on idly at changes in the external environment. One of NAGASE’s strengths is that it has a solid financial base that allows it to take decisive action at the right time when needed. Therefore, we will carefully assess risks and opportunities and make the investment decisions needed to achieve growth.

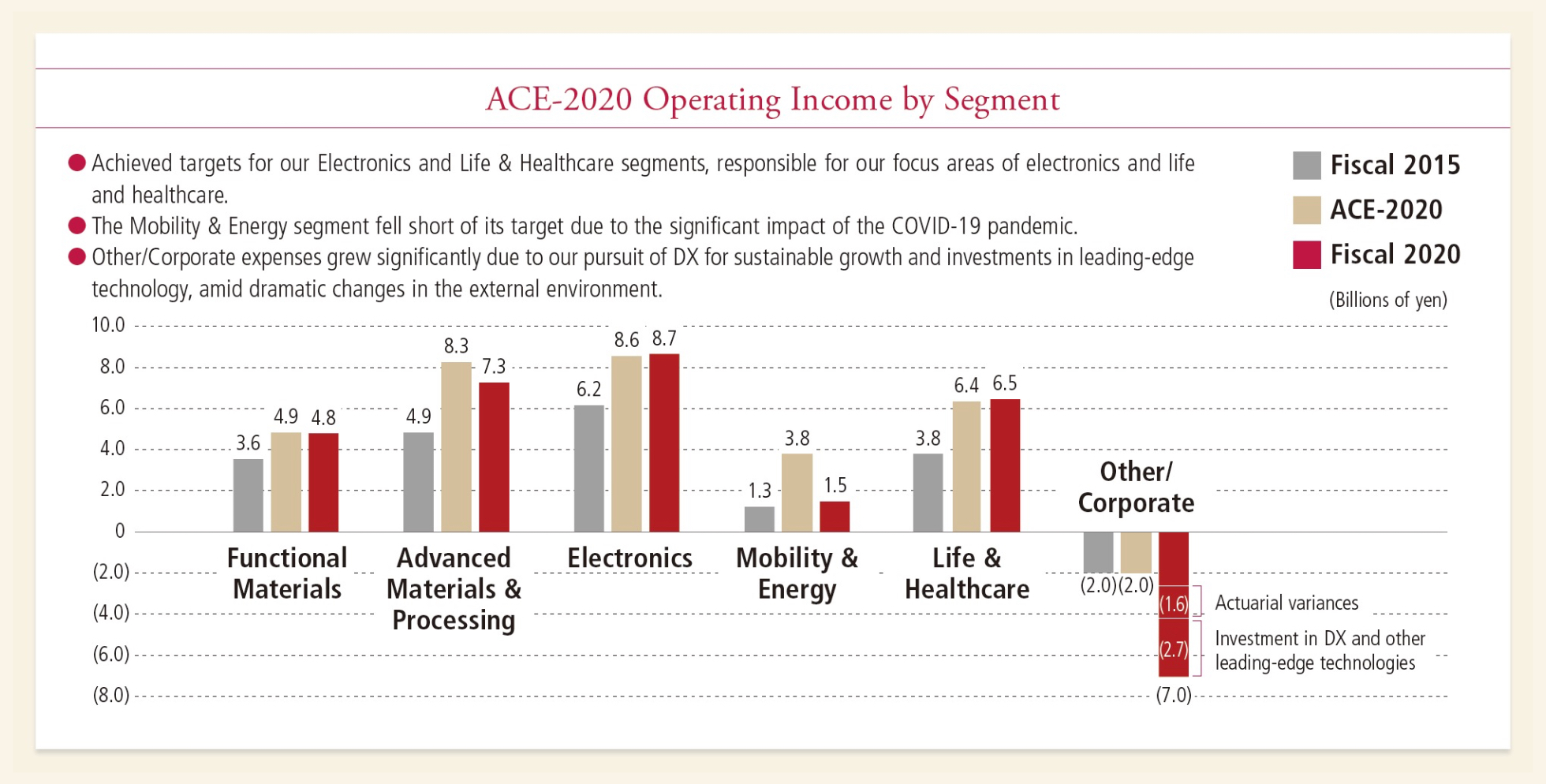

Summary of ACE‑2020

Reforms to Reduce Our Dependence on the External Environment Are Still in Progress

Under ACE‑2020, our previous medium‑term management plan, we set the following targets: consolidated net sales of ¥1.0 trillion or more, consolidated operating income of ¥30.0 billion or more, and ROE (Return on Equity) of 6.0% or more. These ambitious targets reflected our hopes to realize reform of our profit structure and corporate culture, which would be needed to attain our targeted business scale. Ultimately, the NAGASE Group posted consolidated net sales of ¥830.2 billion and consolidated operating income of ¥21.9 billion. Given the conditions faced in the plan’s final year, I do not think the Group posted subpar results. However, I deeply regret the fact that we were unable to achieve our targets, and I felt responsibility for this outcome. Notably, I believe that we could have accomplished much more in terms of reforming our traditional profit structure.

I believe that the real reason why we fell short of our targets was that we did not generate as much growth as we had expected in inorganic businesses that are not easily affected by the external environment. During the fiscal year, while there were periods when our results were encourag‑ ing, we were ultimately supported by organic businesses that rise and fall considerably with the external environment. Under ACE 2.0, our new medium‑term management plan launched in April 2021, we will continue to work on reform of our business model and profit structure.

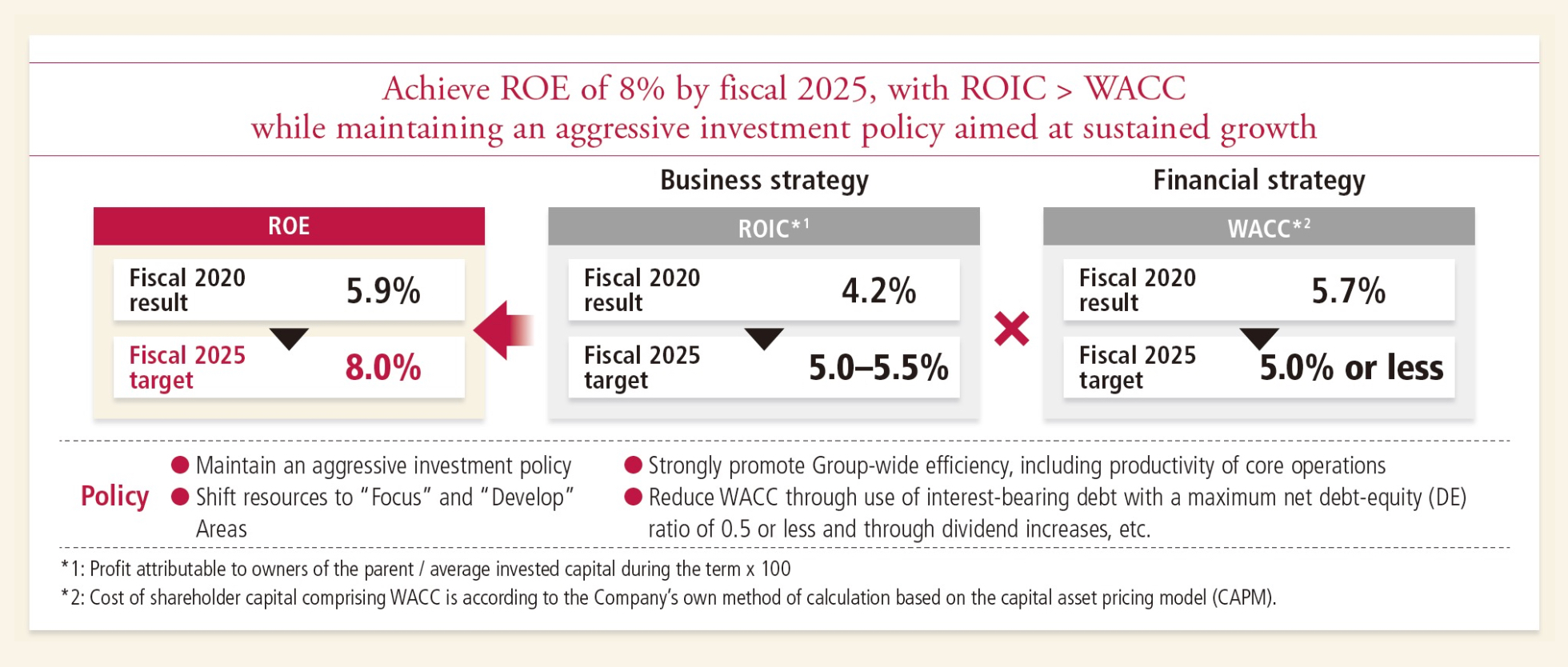

ROE, an indicator of our earning capability, was 5.9%, almost reaching our target of 6%. Although I see this result as commendable, I believe it is still very far from meeting the standard expected by investors. Under ACE 2.0, we aim to achieve further improvement in ROE as well.

Goals for ACE 2.0

Pursuing Profitability and Efficiency through Full-Scale Utilization of ROIC

Under ACE 2.0, we have continued to adopt the theme of reform of our profit structure from the previous medium‑term management plan. Through the pursuit of profitability and efficiency, we will work to implement company‑wide asset replacement and reallocation of resources.

Specifically, we have classified our business portfolio into four domains, specifically the focus, growth, improvement and base areas based on the two criteria of growth potential and cost of capital. Capital will be intensively allocated to the focus areas and growth areas. We envision shifting around 10% of all invested capital to the focus areas and growth areas. Return on invested capital (ROIC) will be employed in earnest as an indicator of our earning capability, taking into account the cost of capital. We will actively invest in businesses that can generate returns in excess of the cost of capital, which is our standard.

ROIC is an indicator of investment efficiency that measures the amount of returns generated by funds invested in a business. I believe that ROIC sends a clear message not only to investors but also to staff within the company. It is natural to find a wide range of decision‑making criteria for evaluating businesses given that staff in each business have their own unique ideas. That is exactly why it is crucial to objectively identify business value as a company from the perspective of ROIC. We will divide our business into more than 100 categories, calculate the ROIC of each business, and carry out PDCA cycles. In the process, we will operate an internal system for monitoring activities and holding discussions to make investment decisions and evaluate businesses.

I am sometimes asked by shareholders and other investors whether we will withdraw from businesses that have a negative ROIC. We will not necessarily evaluate businesses using only short‑term ROIC. The ultimate goal is to achieve sustainable growth in corporate value, so we have set the evaluation period for ROIC not as a single fiscal year but as a period spanning several years to a medium‑term horizon. My job is to allocate capital while adroitly maintaining balance by taking care of our organic businesses, which are our backbone, along with allocating the cash generated by our existing business foundation to the focus areas and growth areas.

In the case of the NAGASE Group, working capital inevitably accounts for a large share of invested capital, partly due to the features of the traditional trading business and market characteristics. Another issue is low profitability. If we only increase the number of businesses with small profit margins, our prospects for sustained growth will be limited. The most important priorities for realizing high profitability will be to increase the number of high‑value‑added businesses based on reliable technologies and build a foundation for technological innovation that spurs the development of that added value further. In this sense, I believe that the NAGASE Group’s unique DX (Digital Transformation) initiatives will provide an important mechanism for creating even more added value.

Improving ROE by Pursuing Top‑Line Growth

The NAGASE Group seeks to achieve an ROE target of 8.0%. In order to consistently and continuously increase ROE, we must pursue top‑line growth, meaning that we must increase our earning capability. I believe that our top line will steadily grow as we invest in businesses with a positive ROIC, and our ROE will also increase. Even if our WACC (Weighted Average Cost of Capital) were reduced through technical factors and ROE were to increase as a result, questions would remain about the sustainability of the outcome. We need to reshape our capital structure so that ROE increases sustainably. We will control WACC steadily at low levels, increase earnings further, and sustainably improve ROE. These efforts will lead to sustainable growth in corporate value.

Investors often tell me that the NAGASE Group must improve the soundness of its capital structure further. One issue that they often point out is control of financial assets such as treasury shares and cross‑shareholdings. The Group will successively review cross‑shareholdings and allocate the funds generated through this process to new strategic investments and the repayment of debt. In parallel, we will implement financial strategies such as returning profits to shareholders through share buybacks. By continuing these activities, I am confident that the NAGASE Group can achieve its ROE target of 8.0%.

Pushing Forward with “Reforms of Profit Structure” and “Reform of Corporate Culture” with a Focus on Sustainability

ACE 2.0 states that improving the productivity of the manufacturing business is also essential to the sustainable growth of the Group. In the NAGASE Group’s manufacturing business, Nagase ChemteX Corporation and Hayashibara Co., Ltd. have so far served as the core companies. In August 2019, Prinova Group joined the NAGASE Group. In addition, the Group Manufacturers’ Collaboration Committee (hereinafter MCC) was set up in 2019 to provide cross‑company coordination for Group manufacturing companies in Japan. In the health and safety, quality, and environmental fields, MCC is working to improve the quality of the NAGASE Group’s manufacturing business. Moreover, MCC is working to differentiate the NAGASE Group in the areas of distribution, production and R&D by harnessing DX further.

Furthermore, I believe that the key to the NAGASE Group’s future growth lies in developing our technology development capabilities, or, in other words, developing our R&D operations. On this front, we will achieve our goals through efforts both within and outside the company. R&D efforts within the company refer to the NAGASE Group’s internal efforts to develop technologies. Developing R&D outside the company refers to activities to support and develop the technology development capabilities of our business partners. For the latter, I believe that TABRASA™ will have a pivotal role to play. TABRASA™ is a new materials search platform that will assist with the development of new materials by chemicals and biomaterials manufacturers through the use of AI and digital technology. We will harness and develop TABRASA™ as a DX tool that increases the NAGASE Group’s added value by supplying needs that customers and business partners have not yet realized that they have. If the entire industry becomes healthy and vibrant, I believe that this will come back to benefit the NAGASE Group.

In closing, the promotion of sustainability, which has now become a global priority, is one of the key issues of ACE 2.0. Addressing sustainability is now an urgent task that cannot be delayed. Unless we face the issue of the sustainability of society in earnest, the Group’s social value will be diminished, and the Group will fall behind the most important trends of the times. I have a strong sense of urgency because I feel that this threat is imminent right now. I intend to continuously push ahead with reforms of our profit structure and corporate culture with a focus on sustainability, with the aim of achieving sustained growth in the NAGASE Group’s corporate value.

Integrated Report 2021

Download All Pages

Download Separate Files

Story for Value Proposition of the NAGASE Group(2.2MB)

Overview of Our Value Creation Story | Our Social Significance | History of Value Creation | Our Business Model | Important Management Resources | Our Risks and Opportunities | [Feature] New Business Looking to the Future | Our Sustainability Management

CEO Message | CFO Message | Business Model Evolution Looking to the Future | Shaping Value 1: Reform of Profit Structure | Shaping Value 2: Reform of Corporate Culture | Shaping Value 3: Corporate Functions Supporting Reform

List of Businesses | Functional Materials Segment | Advanced Materials & Processing Segment | Electronics & Energy Segment | Mobility Segment | Life & Healthcare Segment | Regional Strategy

Sustainability Management(1.8MB)

Our Board | Corporate Governance | Interview with the Outside Directors | Compliance | Risk Management & Responsible Publicity and Marketing | Human Resource Development to Drive Innovation | Creating Environmental Value | Human Rights and Labor Management, Vibrant Work Environments & Responsible Supply Chain | Social Contribution Activities

11-Year Financial Highlights | Financial Information | Consolidated Subsidiaries, Affiliates and Offices | Investor Information | Corporate Information